THEMES / SYSTEM DYNAMICS

S2 | Systems Analysis To Explore Narratives Of Sustainable Prosperity

Achieving sustainable prosperity requires compelling social narratives and robust economic models to test ideas. In our System Dynamics Theme we are exploring the economic underpinnings of existing narratives of sustainable prosperity, as well as developing new narratives. We are thus investigating the economic, social and environmental implications of a wide variety of narratives using qualitative research and macro-economic models. We have a particular focus on the role of good work in delivering sustainable prosperity. Browse through updates from this theme on the news page. Read on for detailed information about the work programme.

Summary

Our system dynamics theme uses empirically-calibrated, economic system models to explore visions of sustainable prosperity. It is composed of two parallel main strands: the first is the exploration of narratives of sustainable prosperity, and their theoretical underpinnings; the second is the development of models for the analysis and testing of the economic, financial, environmental and social dimensions of these narratives. We work with our partners within CUSP and with external organisations such as the Institute and Faculty of Actuaries, to draw up plausible and contrasting visions of sustainable prosperity.

Blog posts

COVID-19 and the Economic Stories of our Time | Blog by Simon Mair

Modelling Transition Risk | Blog by Tim Jackson

Programme

S2.1 | Model Development

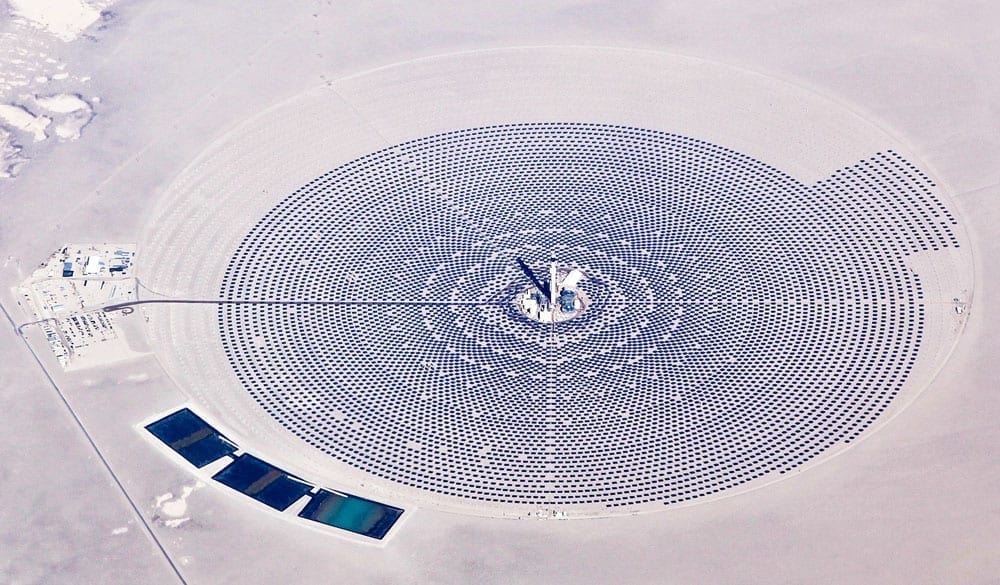

At the heart of Prosperity without Growth is the call for a new ‘ecological macro-economics’: an understanding of the dynamics of the modern economy that can also incorporate the reality of ecological and resource constraints. A critical challenge for this new approach is the need to ensure economic and social stability even as relentless growth in consumer demand is attenuated. Forging a ‘post-growth’ economics is central to our work. Historically, socially and physically grounded, our work draws on a wide range of theoretical and conceptual approaches—including ecological economics, post-Keynesian economics, and systems dynamics. We are developing a suite of models capable of describing sustainable economies, and the transitions to such economies, that operate within ecological limits. These include the FALSTAFF model which explores the financial and economic dimensions of a post-growth economy; the TRansit and TransSim models, both of which look at the transition risks and opportunities associated with the transition to a net-zero carbon economy; the SIGMA model which addresses the key challenge of inequality in the context of declining growth rates; the LowGrow SFC model which generates alternative future scenarios for the Canadian economy out to 2067; and the EETRAP model which shows the difficulty of transitioning to renewable energy when differences between fossil fuels and renewable energy sources in terms of energy return on energy invested are taken into account. In other work, the ERRE model, which takes inspiration from World3, takes a shorter term approach. Its aim is to evaluate the systemic risk generated by food and energy supply trends and shocks, and their interactions with the material, financial and knowledge economies, under the constraints of a finite planet. It thus addresses the question: What are the systemic and cascading risks in the near term in financial and economic systems as a result of resource scarcity? Future developments include a model to explore the opportunities and challenges associated with an energy sector transition to zero carbon focussing on the UK economy; a Stock-Flow Consistent Input-Output Model that investigates energy transitions pathways; and a system dynamics model of rent extraction in the UK housing market.

S2.2 | Narratives for Sustainable Prosperity

There are, of course, many diverse visions of sustainable prosperity, and this strand of work is focused on exploring alternative narratives in the context of the broad CUSP themes. Work here focuses on expanding our understanding of what a sustainable and prosperous future could hold. For example, working closely with the other CUSP themes we are exploring the concept of utopia. In particular we are using utopian fiction as sources of inspiration and reflection for sustainable futures. We are also exploring different visions of state welfare provision in a post-growth economy, considering how we might structure our welfare state and its surrounding institutions to provide sustainable welfare without economic growth.

S2.3 | Understanding and Measuring Sustainable Economies

Drawing together the work on narratives of sustainable futures and economic modelling, we are analysing and developing the building blocks of economic theory required to support better futures and transitions to them. This involves exploring key dynamics within widely used economic models, uncovering the historical roots of modern economic ideas, assessing the economic and financial risks and opportunities implied by different types of transitions to a net-zero carbon economy, and building new theoretical tools.

Substantively, we are exploring the macroeconomic and financial stability of different assumptions about investment, public spending, consumer behaviour and the money supply. A core aspect of the analysis (see also Project S2.4 below) focuses on questions concerning work, employment, labour productivity, the substitution between labour and capital, and the implications of how these elements are conceptualised in different economic traditions. An additional element is focusing on the finance sector, including the creation of money, and the potential for innovative investment models. Further analysis is investigating the resilience of the economy (and in particular the finance sector) to explore the challenges of stranded assets, and to assess what factors might lower the risks from wild card or shock events (such as acts of war disrupting energy supply chains or climate change events impacting on food availability).

While our analyses report on a variety of indicators such as GDP, resource use, emissions, employment, inequality and wellbeing, the most appropriate indicator set to describe sustainable prosperity is not an easy or obvious choice. In the context of growing interest in alternative indicators to GDP, we are working closely with WWF and international governance organisations to better understand the policy context in which indicators are being deployed, and to identify how they can best contribute towards bringing new narratives of sustainable prosperity into decision-making. We are also participating in the Ecological Footprint Initiative being led by York University in Canada.

S2.4 | Calibrating Good Work

Building on the employment focus in theory building (S2.3), we are exploring the relationship between the quality of work, adoption of ICT, labour productivity and environmental impact using qualitative and quantitative methods. Also, drawing on insights from Prosperity Without Growth, and working closely with the Arts and Culture project we are testing the hypothesis that there exists a ‘sweet spot of good work’ in which certain sectors of the economy offer a triple dividend: low environmental impact, high labour intensity, and high levels of worker satisfaction, with especial focus on the health and social care sector.

Publications

Using representative surveys in the UK and US with over 5,000 participants, a new study by CUSP fellow Dario Krpan and colleagues Fred Basso, Jason Hickel, and Giorgos Kallis finds that—contrary to common political and media claims—the majority of respondents support degrowth when presented with the full proposal, regardless of the label.

In high-income countries, where continued economic expansion may no longer be possible or desirable, the future of work is increasingly debated—often with conflicting views on labour productivity. This paper examines the role of labour offshoring in shaping productivity gains and considers the implications for post-growth proposals.

In this paper, Seán Fearon et al. use time use analysis combined with emissions and wellbeing data to model 2050 lifestyles in Finland, France, and the UK, showing that while certain time use changes can improve wellbeing and reduce emissions, radical transformations in provisioning systems are still needed to stay within planetary boundaries.

This paper examines how slower growth in advanced economies may force a choice between fiscal tightening and rising debt. It shows that more flexible approaches to monetary and fiscal policies can better support debt stability and long-term economic, social and environmental goals.

Forthcoming book by CUSP director Prof Tim Jackson, exploring the concept of care in the economy, its undervaluation in markets, and its profound importance for health and society. Dive into the history of medicine, capitalism’s impact on health, and the gender politics of care. Irreverent, insightful and profoundly inquisitive, The Care Economy offers a bold and accessible manifesto for a healthier and more humane society.

This working paper by Dario Leoni, Andrew Jackson and Tim Jackson describes the post-Keynesian SFC PADME Model which explores two regional economies linked by international trade and financial flows, each made up of seven sectors. The theoretical framework underpinning the model is that of ecological economics.

A comprehensive new review by leading experts in the sustainability science field is challenging the long-held assumption that economic growth is necessary for societal progress. Published in The Lancet Planetary Health, this paper explores the rapidly advancing field of postgrowth research and presents a compelling case for prioritising human wellbeing and ecological sustainability over endless economic expansion.

This paper develops a stock-flow consistent, input-output model to simulate risks, opportunities, and non-linear dynamics associated with green investment, energy returns, financial risks, and various energy transition pathways to net zero.

Simon Mair explores energy-capital relations through Adam Smith’s The Wealth of Nations, showing how capital drives energy use and efficiency for profit. He argues low-carbon transitions require investments tied to challenging the profit motive.

In reply to a recent opinion piece in the Financial Times, Prof Peter A. Victor challenges the relevance of David Ricardo’s principle of comparative advantage in today’s world of mobile capital, arguing that it should not be employed to justify regressive environmental and social policies.

The paper evaluates system dynamics energy models, investigating how they capture key characteristics of socio-technical transitions, and recommending the creation of a “policy navigator” to map and guide policy testing within sustainability transition frameworks for better decision-making.

This paper shows that countries with robust health-related policy targets aimed at reducing non-communicable diseases (NCDs) experienced significantly lower mortality rates during the first year of the Covid-19 pandemic.

This commentary responds to a recent article purporting to identify ‘limits to degrowth’. This paper clarifies and sets in context the tensions between growth rates and decoupling rates on which the contested argument is based, disputing the claim that growth is the best way to achieve high rates of decoupling.

Modern economies rely on economic growth for stability and prosperity, but this dependence is ecologically unsustainable. Understanding growth dependency is crucial. We propose a sector-led framework to transform these reliances and disrupt their inevitability.

This commentary, by CUSP researcher Peter A. Victor in the latest C40 Cities journal, reflects on his extensive research of the late Herman Daly’s life and work. A concise summary tailored for policymakers.

We are pleased to announce the release of the audiobook edition of Tim Jackson’s prize-winning book “Post Growth—Life After Capitalism”. Through his own narration, Tim brings a personal touch to the profound themes of Post Growth, offering an accessible and engaging experience for audiences to absorb his insights on the go.

This account of ecological macroeconomics begins with its origins, including the development of some of its defining components by key contributors, followed by an overview of recent research in ecological macroeconomics with an emphasis on models. It concludes with a set of research questions that give some idea of possible future directions for the discipline.

This working paper describes a two-region post-Keynesian stock-flow consistent macroeconomic model set out to analyse macroeconomic implications of a postgrowth transition in advanced countries on the economic and environmental conditions in the rest of the world.

Earth is in overshoot. The relentless pursuit of economic growth in the name of “progress” has stressed the planet beyond its limits. This richly illustrated book by CUSP co-investigator Prof Peter A Victor describes the current predicament and how economics can help find a path to a post-growth future.

This working paper describes an extension of the stock-flow consistent FALSTAFF model to test the existence of a monetary growth imperative. The extension is designed to simulate the phenomenon known as Baumol’s cost disease which arises from the existence of differential labour productivity rates in a mixed economy.

Wealthy countries can create prosperity while using less materials and energy if they abandon economic growth as an objective. This Nature comment piece is laying out the key challenges.

In this essay, CUSP researcher Simon Mair explores the ways that academic sustainability writing engages with economic systems and considers the performative effects of these modes of engagement. Through the lens of Capitalist Realism and Capitalocentrism, he defines three mechanisms by which non-capitalist futures are foreclosed.

This paper presents a stock-flow consistent input–output integrated assessment model designed to explore the dual dynamics of transitioning to renewable energy while electrifying end use subject a carbon budget constraint. Unlike the majority of conventional integrated assessment model analyses, this paper does not assume the deployment of carbon dioxide removal and examines the role that alternative economic pathways (steady-states and degrowth) may play in achieving 1.5°C consistent emissions pathways.

Business models providing used clothing to consumers have the potential to reduce pressure on raw materials and primary production. This research used in-depth interviews and a literature review to improve understanding of alternative business models in the fashion sector.

Ahead of hearings planned for 9 February 2022, the UK Environmental Audit Committee invited written submissions to examine how the UK Government could incorporate environmental sustainability into its leading measures of UK economic success, addressing questions around ‘inclusive wealth’, measurement of national wellbeing, and national government accounting.

SankeySim was developed to support the work of the Council of Canadian Academies Expert Panel on the Circular Economy in Canada and the preparation of their report Turning Point (2021). In this working paper, we describe the SankeySim model that calculates the impact on materials throughput of various measures intended to increase the circularity of the Canadian economy.

The clothing industry is a significant contributor to environmental degradation. Yet, easily accessible life cycle inventory (LCI) data that can be used in decision making by practitioners and researchers are lacking. This study addresses this gap.

New study examining the fashion design process as practised at the mass-market level. The mass-market design process is found to prioritise profits rather than aesthetic aspects, with the buyer exercising more power than the designer. This hinders creativity, which, in turn, may impede a move towards more environmentally benign designs.

The Health and Care Bill has its second reading in the House of Lords on Tuesday 7 December. Coinciding with a new Panorama investigation, Crisis in Care: Follow the Money, this briefing proposes three ways in which the Health and Care Bill should be amended to tackle the harmful impacts of financialisation in the care home sector.

As the first biography of Professor Herman Daly, this book provides an in-depth account of one of the leading thinkers and most widely read writers on economics, environment and sustainability. Drawing on extensive interviews with Daly and in-depth analysis of his publications and debates, Peter Victor presents a unique insight into Daly’s life from childhood to the present day, describing his intellectual development, inspirations and influence.

Reaching the UK net-zero emissions target translates into substantial investment requirements into low-carbon energy infrastructure. However, investors are currently not investing sufficiently in renewable energy capacity, leading to the so-called green finance gap.

This paper is an update of an earlier briefing note, revised to take account of new findings from the IPCC’s updated 6th Assessment Report (AR6). The broad aim of the paper is to establish how soon the UK should aim for (net) zero carbon emissions.

Journal paper by Sarah Hafner, Aled Jones and Annela Anger-Kraavic, developing a system dynamics energy-economy model to explore the long-term macroeconomic effects, and changes in the power system costs of different low-carbon electricity transition scenarios. The paper argues that an early retirement of a certain amount of brown energy infrastructure is required, and needs to be determined with care.

Post‐pandemic recovery must address the systemic inequality that has been revealed by the coronavirus crisis. The roots of this inequality predate the pandemic and even the global financial crisis. They lie rather in the uneasy relationship between labor and capital under conditions of declining economic growth.

This paper presents a systems dynamics model for exploring possibilities for achieving four SDGs (SDG-1, SDG-8, SDG-12, and SDG-13) in Iran. The model is used to generate four possible stories about the implementation of measures to achieve these SDGs in the future of the Iranian economy from 2020 to 2050. The results of the simulations shows that transformational scenarios provide better pathways in comparison to conventional scenarios. Moreover, transformational policy changes and extraordinary efforts are required for progress in achieving SDGs overall.

The TranSim modelling work shows that the negative effects associated with the transition—recession, stagnation, stagflation, increasing inequality and asset stranding—are positively related to the capital intensity of green energy production and reductions in EROI. Policy makers should pay close attention to the overall EROI of the entire energy system when determining energy policy. If significant reductions in EROI are unavoidable, then policy could be used to mitigate some of its negative economic effects.

This working paper summarises the initial findings of a project whose aim has been to develop an agent-based (AB), stock-flow-consistent (SFC) macroeconomic framework to study the economic, financial and social implications of the transition to a net zero carbon economy.

Well-known academic and non-academic institutions call for a new approach in economics able to capture features of modern economies including, but not limited to, complexity, non-equilibrium and uncertainty. In this paper, we provide a systematic review of ecological macroeconomic models that are suitable for the investigation of low-carbon energy transitions and assess them based on the features considered desirable for a new approach in economics.

This paper presents a stock-flow consistent (SFC) macroeconomic simulation model for Canada. Contrary to the widely accepted view, the results suggest that ‘green growth’ (in the Carbon Reduction Scenario) may be slower than ‘brown growth’. More importantly, we show (in the Sustainable Prosperity Scenario) that improved environmental and social outcomes are possible even as the growth rate declines to zero.

Global economic stability could be difficult to recover in the wake of the Covid-19, this Nature article finds. Even before the Covid-19 crisis, many of the world’s leading economies were experiencing larger slower growth cycles (recession cycles), suggesting precisely such a period of critical slowing down in the economic system. This analysis suggests that the added weight of the Covid-19 crisis may result in one of the weakest and most unstable recoveries in recorded history for many economies.

New book by CUSP researchers Roberto Pasqualino and Aled Jones, presenting a novel stock and flow consistent global impact assessment model (ERRE) designed by the authors to address the financial risks emerging from the interaction between economic growth and environmental limits under the presence of shocks.

Rapid decarbonisation of the UK energy sector demands high levels of investments into low carbon energy infrastructure, which are currently not undertaken at required scale. In a new paper, CUSP researchers Sarah Hafner, Aled Jones and colleagues explore a theoretical framework for investigation of and possible solutions to key investment barriers, drawing on a review of academic literature and policy reports, and interviews conducted with financial investors and experts.

It is clear that the larger the economy becomes, the more difficult it is to decouple that growth from its material impacts… This isn’t to suggest that decoupling itself is either unnecessary or impossible. On the contrary, decoupling well-being from material throughput is vital if societies are to deliver a more sustainable prosperity—for people and for the planet. (This article is posted on the Science website).

This working paper presents a stock-flow consistent (SFC) simulation model of a national economy, calibrated on the basis of Canadian data. LowGrow SFC describes the evolution of the Canadian economy in terms of six financial sectors whose behaviour is based on ‘stylised facts’ in the Post-Keynesian tradition. Contrary to the accepted wisdom, the results indicate the feasibility of improved environmental and social outcomes, even as the growth rate declines to zero.

This briefing paper summarises the dilemma associated with using mainstream, macroeconomic models to guide disruptive, transformative change such as those that might occur under ‘deep decarbonisation’: a rapid transition to a net-zero carbon economy. Some form of macro-economic modelling framework is essential to enable policy-makers to exercise short- and long-term fiscal responsibility. Incremental models based on historical behaviour, however, are a poor guide to outcomes under circumstances of disruptive change.

Journal paper by CUSP researchers Robert Pasqualino, Aled Jones and WU colleague Irene Monasterolo, analysing impact scenarios of exogenous price, production, and subsidies shocks in the food and/or energy sector. By merging structures of the World3, Money, and Macroeconomy Dynamics (MMD) and the Energy Transition and the Economy (ETE) models, this work presents a closed system global economy model, where growth is driven by population growth and government debt.

CUSP briefing addressing the question of when the UK should aim for zero carbon emissions. In it, Prof Tim Jackson is making the case for a (fair) zero carbon target of 2030, calling for a policy strategy not only on zero carbon targets, but emission pathways, with a defined level of negative emission technologies. It is notable that reduction rates high enough both to lead to zero carbon (on a consumption basis) by 2050 and to remain within the carbon budget require absolute reductions of more than 95% of carbon emissions as early as 2030.

Sluggish recovery in the wake of the financial crisis has revived discussion of a ‘secular stagnation’. These conditions have been blamed for rising inequality and political instability. Tim Jackson contests this view, pointing instead to a steadfast refusal to address the ‘post-growth challenge’. (An earlier draft of the article was published as CUSP Working Paper No 12.)

Revised second edition of Peter Victor’s influential book. Human economies are overwhelming the regenerative capacity of the planet, this book explains why long-term economic growth is infeasible, and why, especially in advanced economies, it is also undesirable. Simulations developed with Tim Jackson, show that managing without growth is a better alternative.

Maintaining steady growth remains the central goal of economic policy in most nations. However, as evidenced by the advent of the Anthropocene, the global economy has expanded to a point where limits to growth are appearing. Facing the end of growth requires a careful re-examination of plausible future conditions. This paper draws on a diverse literature to present an interdisciplinary exploration of post-growth conditions.

System dynamics model by Tim Jackson and Peter Victor, developing low carbon and sustainable prosperity scenarios for the Canadian economy out to 2067. The scenarios are not predictions of what will happen, but an exploration of possibilities. Interested readers can explore the implications for themselves in the online beta version of the model.

The need for an environmentally sustainable economy is indisputable but our understanding of the energy-economy interactions (dynamics) that will occur during the transition is insufficient. This raises fascinating questions on the future of economic growth, energy technology mix and energy availability.

Sluggish recovery in the wake of the financial crisis has revived discussion of a ‘secular stagnation’. These conditions have been blamed for rising inequality and political instability. Tim Jackson contests this view, pointing instead to a steadfast refusal to address the ‘post-growth challenge’.

The requirement to reduce emissions to avoid potentially dangerous climate change implies a dilemma for societies heavily dependent on fossil fuels. As renewable capacity requires energy to construct there is an initial fossil fuel cost to creating new renewable capacity. An insufficiently rapid transition to renewables, it turns out, will imply a scenario in which it is impossible to avoid either transgressing emissions ceilings or facing energy shortages.

Piketty argued that slow growth rates inevitably lead to rising inequality. If true, this hypothesis would pose serious challenges for a ‘post-growth’ society. Fiscal responses to this dilemma include Piketty’s own suggestion to tax capital assets and more recent suggestions to provide a universal basic income that would allow even the poorest in society to meet basic needs.

The publication of Prosperity without Growth was a landmark in the sustainability debate. This substantially revised and re-written edition updates its arguments and considerably expands upon them. Tim Jackson demonstrates that building a ‘post-growth’ economy is not Utopia—it’s a precise, definable and meaningful task. It’s about taking simple steps towards an economics fit for purpose.

This paper explores the use of instability indicators developed in statistical physics to analyse the stability of the GDP within national longitudinal datasets. From our early results it is suggested that they may provide invaluable insights into the inter-decadal dynamics of the macro-economy, providing potentially useful insights into (e.g.) the nature of the business cycle, secular stagnation and the restoring forces of the economy.

Understanding sustainable prosperity is an essential but complex task. It implies an ongoing multidisciplinary and transdisciplinary research agenda. This working paper sets out the dimensions of this task. In doing so it also establishes the foundations for the research of the ESRC-funded Centre for the Understanding of Sustainable Prosperity (CUSP).

Taken together, the suite of system dynamics models developed by Tim Jackson et al represent the first steps in constructing a new macro-economic synthesis capable of exploring the economic and financial dimensions of an economy confronting resource or environmental constraints.

The SIGMA model explores the hypothesis that slow growth rates lead to rising inequality. Contrary to the general hypothesis, the work finds that inequality does not necessarily increase as growth slows down. In fact, there are certain conditions under which inequality can be ameliorated significantly, or even entirely eliminated, as growth declines.

This paper addresses the question of whether a capitalist economy can ever sustain a ‘stationary’ (or non-growing) state, or whether, as often claimed, capitalism has an inherent ‘growth imperative’ arising from the charging of interest on debt. Contrary to claims in the literature, we find that neither credit creation nor the charging of interest on debt creates a ‘growth imperative’ in and of themselves.