Themes / Finance for the Future

Investing in the Future

Our MAPSS themes are drawn together through a number of cross-cutting projects and thematic engagements with policy, business and civil society on issues related to sustainable prosperity. One of these cross-cutting projects is Investing in the Future.

Summary

We are looking at sustainable finance from various angles—our research aims to develop a powerful new framing of investment in terms of a meaningful ‘commitment to the future’. This framing is motivated in part by the lessons from the financial crisis, where speculative, short-term investment was instrumental in undermining financial stability, and in part by the investment needs inherent in the transition to a sustainable, low-carbon economy. Resource productivity, low-carbon infrastructure and the protection of habitats and ecosystems all demand a new portfolio of investment with new governance and facilitating conditions.

Our research aims both to understand the macro-economic challenges posed by this new portfolio and also to explore the pragmatic innovations needed to deliver it. In pursuit of these goals we are (i) developing new economic models of sustainable finance and (ii) engaging with stakeholders at the local, national and international level to transform the insights arising from this research into practice. Our modelling aims to explore issues as varied as: the stranding of conventional (fossil fuel) assets; the stability of financial (and social) returns on sustainable assets; and the relevance of new local and community-led finance for sustainable prosperity. Our stakeholders include businesses, policy-makers, parliamentarians, civil society organisations and the wider public.

One of our core projects is carried out together with the Aldersgate Group, an alliance of leaders from business, politics & society driving action for a sustainable economy. Based on its strong relationships with businesses and financial institutions involved in the green or low-carbon economy, we are focusing on what changes are necessary at a policy, regulatory and business-model level to increase the flows of finance towards green infrastructure projects in areas such as energy efficiency, renewable energy and the improvement of valuable natural assets. The UK serves as the concrete case study and anchor for the research but the work also draws on examples from the EU and beyond. We focus on a variety of investments including: low carbon energy; ecological investment in ‘natural capital’ and resource efficiency or ‘circular economy’ projects. The challenge, we find, is not lack of capital, but a lack of confidence. We need a policy framework that makes investment in low carbon energy generation infrastructure attractive, to boost private spending and growth in this sector, create jobs and generate higher tax revenues for government.

Blog posts

Publications

Against the backdrop of an urgent need for change of the fashion and textile industry towards more sustainability, this new research report explores how nature positive action can be embedded in UK Textile and Fashion SMEs. It examines what financial and other support is required to achieve this, and how SMEs can develop their environmental reporting to aid investors and other stakeholders in making decisions.

New report examining the rapidly evolving UK early-stage green innovation finance landscape, exploring how start-ups and their investors navigate complex funding pathways to support nature-positive business models. Drawing on extensive stakeholder insights, it highlights both the growing momentum and the significant gaps in measuring, financing, and scaling SME innovations that can embed biodiversity and nature value into investment decisions.

This paper examines how slower growth in advanced economies may force a choice between fiscal tightening and rising debt. It shows that more flexible approaches to monetary and fiscal policies can better support debt stability and long-term economic, social and environmental goals.

New research by Amy Burnett and Fergus Lyon explores how cooperative governance models can help farmers retain control over nature recovery initiatives, preventing corporate capture. Drawing on insights from the Environmental Farmers Group and the agri-food sector, the study highlights the role of collaboration in emerging natural capital markets.

This paper develops a stock-flow consistent, input-output model to simulate risks, opportunities, and non-linear dynamics associated with green investment, energy returns, financial risks, and various energy transition pathways to net zero.

Simon Mair explores energy-capital relations through Adam Smith’s The Wealth of Nations, showing how capital drives energy use and efficiency for profit. He argues low-carbon transitions require investments tied to challenging the profit motive.

In reply to a recent opinion piece in the Financial Times, Prof Peter A. Victor challenges the relevance of David Ricardo’s principle of comparative advantage in today’s world of mobile capital, arguing that it should not be employed to justify regressive environmental and social policies.

The article explores how modern capitalism’s shift from labour to assets creates a legitimation crisis of contemporary wealth-based capitalism, leaving wealth elites grappling with meaning, purpose, and survival in a system devoid of traditional moral justification.

This report focuses on how to finance the green transition of established SMEs in England. Prior demand-side research demonstrated that surveyed SME access to debt finance for the ‘green transition’ is uneven across the UK and that smaller, less resourced SMEs in more remote locations from banking centres may be most disadvantaged.

This paper explores the crucial issue of financing early-stage green startups, focusing on the types of investors, financial models available, challenges these startups face, and how the green finance ecosystem can better support them.

In this briefing, the Aldersgate Group together with CUSP outlines necessary next steps from Government to accelerate the adoption of high-quality nature-related disclosures. This follows the announcement that 320 businesses and financial institutions have registered as early adopters of the Taskforce on Nature-related Financial Disclosures’ (TNFD) disclosure framework.

CUSP partners at the Aldersgate Group have coordinated a cross-business letter to UK Prime Minister Rishi Sunak, urging Government for leadership and stronger commitment to the green economy.

This Aldersgate Group report with CUSP calls on the UK Government to provide a strong legal basis for financial regulators to support the transition to a net zero and nature positive economy. It finds that financial regulators are limited by a narrow mandate on climate, capacity and resource constraints, and a lack of comprehensive net zero-aligned policy across the economy.

This working paper describes a two-region post-Keynesian stock-flow consistent macroeconomic model set out to analyse macroeconomic implications of a postgrowth transition in advanced countries on the economic and environmental conditions in the rest of the world.

SMEs play a key role in transitioning to net zero. Theresia Harrer and Robyn Owen explore why funding problems are so persistent for early-stage Cleantech ventures. An institutional logics lens is adopted to analyse how key actors’ perceptions and communications of the Cleantech value proposition shape information asymmetries, and how these may be overcome.

Paper by Robyn Owen et al investigating how external finance, including public supported schemes, impact on the low carbon and ‘green’ growth of UK SMEs?

This Aldersgate Group report with CUSP calls for rapid action to implement and strengthen the UK Government’s proposed reforms on climate reporting and disclosure. The briefing also outlines the next steps that must be taken to support corporations and financial institutions to comply cost-effectively with these new requirements, and ensure that new reforms help deliver genuine emission reductions in the real economy.

Through a series of in-depth interviews with care workers Christine Corlet Walker et al explore the impact of investment firms on working conditions and quality of care in UK care homes. Combined with an analysis of care company accounts generating insights into the impacts of financialisation on the UK care sector, the report shows how investment firms are using extreme strategies to reduce staffing levels and cut costs in the name of profit, with appalling consequences for care.

This paper presents a stock-flow consistent input–output integrated assessment model designed to explore the dual dynamics of transitioning to renewable energy while electrifying end use subject a carbon budget constraint. Unlike the majority of conventional integrated assessment model analyses, this paper does not assume the deployment of carbon dioxide removal and examines the role that alternative economic pathways (steady-states and degrowth) may play in achieving 1.5°C consistent emissions pathways.

This paper seeks to explore how professionals in the financial sector understand the challenge that climate change presents to economy and society. It is a case study into how ‘climate-related financial risk’ is understood in a particular area of expertise—within the actuarial profession.

Vast sums of public money are invested into universities globally as anchor institutions and knowledge bases providing seedbed resources for research and development and entrepreneurship. This paper examines two UK case studies of government support from the “Innovation Knowledge Centre” (IKC) program to translate research into industry innovation for public good.

How do Business Accelerators and Business Angels’ assess the human capital of socio-environmental mission led entrepreneurs? This paper investigates the role of entrepreneurs’ human capital on the potential of newly created ventures to receive equity funding from Accelerators and Business Angels using a resource-based approach to entrepreneurship theory.

Letter by John Meadley and CUSP director Tim Jackson to the Financial Times, highlighting the urgent need for decent land use policy, to prevent the same predatory financial practices prevalent in the social care sector from taking hold in rural communities too.

In the years since the financial crisis, a heated debate has broken out amongst macroeconomists about the appropriate roles of fiscal and monetary policy in managing public sector debt. This working paper and accompanying policy briefing introduce the main lines of argument on both sides of the controversy. We find i.a. that a return to fiscal austerity would be both dangerous and unjustified and that moving beyond ideology is key to the levelling-up agenda.

The Health and Care Bill has its second reading in the House of Lords on Tuesday 7 December. Coinciding with a new Panorama investigation, Crisis in Care: Follow the Money, this briefing proposes three ways in which the Health and Care Bill should be amended to tackle the harmful impacts of financialisation in the care home sector.

This article addresses a pertinent question facing government policymakers: how best to support VC to achieve climate change objectives? Based on over 100 in-depth interviews, it focuses on the supply-side policy, design, and implementation of four UK government-backed venture capital funds (GVCFs) at various stages of their development.

Interest in the social and environmental ‘purpose of business’ is growing. Could it be part of a move towards a better kind of economy and what kind of investment is needed? CUSP Fellow Dr Jess Daggers points to the history of the social investment market in the UK as a source of insight into the attempt to combine financial tools and social purpose.

In this new report, the Aldersgate Group and CUSP urge the Government to use the UK’s current leadership position on climate change and the environment, and its ongoing review of financial services regulations, to embed environmental sustainability into the rules governing the UK’s financial system and influence similar changes to international rules and standards.

A new joined-up post-Covid biodiversity policy paper argues that addressing biodiversity loss requires a transformative change of the global economic system, and concludes that the COVID‐19 pandemic, and current delays in the negotiation of the post‐2020 global biodiversity agenda of the Convention on Biological Diversity heighten the urgency to build back better for biodiversity, sustainability, and well‐being.

Adult social care across the OECD is in crisis. Covid-19 has exposed deep fragilities. Principal amongst these is the process of marketisation and financialisation of the social care sector. In this paper, we take a critical perspective on this process. We find that marketisation has facilitated the conditions for both financial fragility and operational failure; and argue that post-pandemic recovery represents a once-in-a-generation opportunity to overhaul these conditions and transform adult social care.

The Financial Independence Retire Early (FIRE) community consists of individuals each personally dedicated to reducing consumption, so as to build up financial surpluses that are eventually adequate to live off. Using semi-structured interviews with leading FIRE advocates and analysis of books and blog content, this paper assesses the ambivalent moral economy of FIRE.

This working paper summarises the initial findings of a project whose aim has been to develop an agent-based (AB), stock-flow-consistent (SFC) macroeconomic framework to study the economic, financial and social implications of the transition to a net zero carbon economy.

The COVID-19 pandemic has caused dramatic and unprecedented impacts on both global health and economies. Many governments are now proposing recovery packages to get back to normal, but the 2019 Intergovernmental Science-Policy Platform for Biodiversity and Ecosystem Services Global Assessment indicated that business as usual has created widespread ecosystem degradation. Therefore, a post-COVID world needs to tackle the economic drivers that create ecological disruptions.

Following extensive cross-industry and civil society engagement, our partners at the Aldersgate Group published a new report, setting out some of the key policy decisions that need to be taken in this parliamentary term to put the UK on a credible pathway to building a competitive, net zero emissions economy.

This paper presents a stock-flow consistent (SFC) macroeconomic simulation model for Canada. Contrary to the widely accepted view, the results suggest that ‘green growth’ (in the Carbon Reduction Scenario) may be slower than ‘brown growth’. More importantly, we show (in the Sustainable Prosperity Scenario) that improved environmental and social outcomes are possible even as the growth rate declines to zero.

Through the APPG on Limits to Growth, MPs across the political spectrum have written to the UK Chancellor, urging him to prioritise wellbeing over GDP growth statistics if his plans to rebuild the economy after Covid-19 are to lead to a green recovery.

New book by CUSP researchers Roberto Pasqualino and Aled Jones, presenting a novel stock and flow consistent global impact assessment model (ERRE) designed by the authors to address the financial risks emerging from the interaction between economic growth and environmental limits under the presence of shocks.

This paper presents the results of a thematic coding analysis of a workshop comprised of senior accountants and actuaries who were asked to consider how a future of sustainable prosperity can be enabled by the finance sector. We found that mindset, skills, external drivers and decision boundaries were key themes that create barriers to change.

How might a Green New Deal be applied to the early stage financing of Cleantechs? Amidst rising interest and adoption of Green New Deals in the US, the paper explores the need for more focused policy to address early stage long horizon financing of Cleantechs.

Current controversies in valuing the cost of environmental changes like climate change and biodiversity loss have exposed serious flaws in standard welfare economics, Peter Victor writes. Many of these arise from the assumption that social value can be calculated using the revealed or stated preferences of self-regarding, narrowly rational individuals. In recent decades, markets and market-oriented thinking have reached into spheres of life traditionally governed by non-market norms.

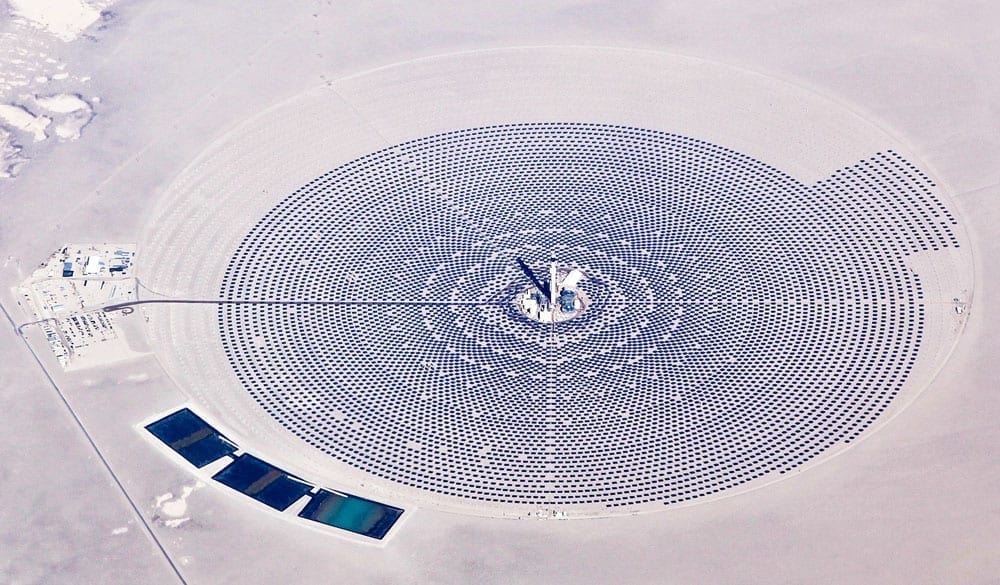

Rapid decarbonisation of the UK energy sector demands high levels of investments into low carbon energy infrastructure, which are currently not undertaken at required scale. In a new paper, CUSP researchers Sarah Hafner, Aled Jones and colleagues explore a theoretical framework for investigation of and possible solutions to key investment barriers, drawing on a review of academic literature and policy reports, and interviews conducted with financial investors and experts.

There is growing awareness that business and investor plans need to better address the growing physical and regulatory risks arising from climate change and climate policy. This policy briefing is discussing how businesses and investors can improve their understanding of these risks and ensure this results in better informed decision making.

This briefing paper summarises the dilemma associated with using mainstream, macroeconomic models to guide disruptive, transformative change such as those that might occur under ‘deep decarbonisation’: a rapid transition to a net-zero carbon economy. Some form of macro-economic modelling framework is essential to enable policy-makers to exercise short- and long-term fiscal responsibility. Incremental models based on historical behaviour, however, are a poor guide to outcomes under circumstances of disruptive change.

CUSP briefing addressing the question of when the UK should aim for zero carbon emissions. In it, Prof Tim Jackson is making the case for a (fair) zero carbon target of 2030, calling for a policy strategy not only on zero carbon targets, but emission pathways, with a defined level of negative emission technologies. It is notable that reduction rates high enough both to lead to zero carbon (on a consumption basis) by 2050 and to remain within the carbon budget require absolute reductions of more than 95% of carbon emissions as early as 2030.

The finance sector has engaged with policy development processes around climate solutions for well over a decade, with the aim of overcoming barriers to investment. In this paper we analyse practice-based policy reports, highlighting key barriers to such investing.

Delivering an effective investment industry has been largely delegated by politicians to regulatory bodies, on the assumption that the measures needed have little relevance to wider social and economic issues. Charles Seaford argues that this assumption is false, and that politicians could usefully consider what may have been seen as purely technocratic issues.

The discourse around ‘natural capital’ potentially offers a way to integrate decisions about the commons effectively into economic decisions. Investing in the commons is key to protecting the flow of services provided to society by natural capital. Recent exploration of the potential for investing in natural infrastructure has highlighted numerous mechanisms, which could help turn this proposition into a reality.

The requirement to reduce emissions to avoid potentially dangerous climate change implies a dilemma for societies heavily dependent on fossil fuels. As renewable capacity requires energy to construct there is an initial fossil fuel cost to creating new renewable capacity. An insufficiently rapid transition to renewables, it turns out, will imply a scenario in which it is impossible to avoid either transgressing emissions ceilings or facing energy shortages.

This paper focuses on the role of the public sector in addressing finance gaps for longer-term investment requirements from seed investment through to early growth commercialisation of green innovation activities. Peer reviewed literature is identified from international studies, complemented by illustrative policy documents where evidence of impact is reported.

Strategic government intervention can maximise opportunities for private green infrastructure investment, our ‘Investing in the Future’ project report with the Aldersgate Group finds, setting out a full list of recommendations for government and industry.

On 16 January 2018, CUSP research fellow Alex White gave evidence to the Environmental Audit Committee on their green finance inquiry. Based on our research with the Aldersgate Group, Alex White argued for the need to create an attractive low carbon investment environment in the UK if we are to see the real benefits of a growing green finance industry.

The publication of Prosperity without Growth was a landmark in the sustainability debate. This substantially revised and re-written edition updates its arguments and considerably expands upon them. Tim Jackson demonstrates that building a ‘post-growth’ economy is not Utopia—it’s a precise, definable and meaningful task. It’s about taking simple steps towards an economics fit for purpose.

This paper explores the ramifications of the combined crises now faced by the prevailing growth-based model of economics. In paying a particular attention to the nature of enterprise, the quality of work, the structure of investment and the role of money, the paper develops the conceptual basis for social innovation in each of these areas, and provides empirical examples of such innovations.

Understanding sustainable prosperity is an essential but complex task. It implies an ongoing multidisciplinary and transdisciplinary research agenda. This working paper sets out the dimensions of this task. In doing so it also establishes the foundations for the research of the ESRC-funded Centre for the Understanding of Sustainable Prosperity (CUSP).

We all want long-term financial performance and the positive sustainability and social outcomes associated with this. However, too often capital markets fail to deliver these. This roundtable will focus on the top of the investment chain: what action can asset owners take?

This paper addresses the question of whether a capitalist economy can ever sustain a ‘stationary’ (or non-growing) state, or whether, as often claimed, capitalism has an inherent ‘growth imperative’ arising from the charging of interest on debt. Contrary to claims in the literature, we find that neither credit creation nor the charging of interest on debt creates a ‘growth imperative’ in and of themselves.