Beyond the Debt Controversy—Re-framing fiscal and monetary policy for a post-pandemic era

Andrew Jackson, Tim Jackson and Frank van Lerven

CUSP Working Paper Series | No 31

Summary

In the years since the financial crisis, a heated debate has broken out amongst macroeconomists about the appropriate roles of fiscal and monetary policy in managing public sector debt.

On one side, orthodox macroeconomics calls for fiscal prudence to control the level of the deficit and debt. On the other, advocates of ‘functional finance’ argue that a government which issues its own currency can never run out of money, so that the size of the national debt and deficit are relatively unimportant. This argument has a particular salience in the context of the investment needs associated with meeting ambitious climate change goals and ‘levelling up’ the inequalities between different communities and regions in the UK.

Both tasks will require significant public investment at a time when public finances have already been stretched by the pandemic.

This briefing introduces the main lines of argument on both sides of the controversy. We conclude that the sovereign ability of government to create money at will exists; but that it is circumscribed by legitimate concerns about its economic impacts.

We argue against a return to fiscal austerity in the aftermath of the pandemic and make the case for greater flexibility in the use of both monetary and fiscal policy—and better coordination between them as the foundation for the post-pandemic recovery.

A perfect storm

Government is facing three significant macroeconomic challenges in the aftermath of what the Office for Budget Responsibility (OBR) has called ‘the largest peacetime economic and fiscal shock in three centuries’.[1]

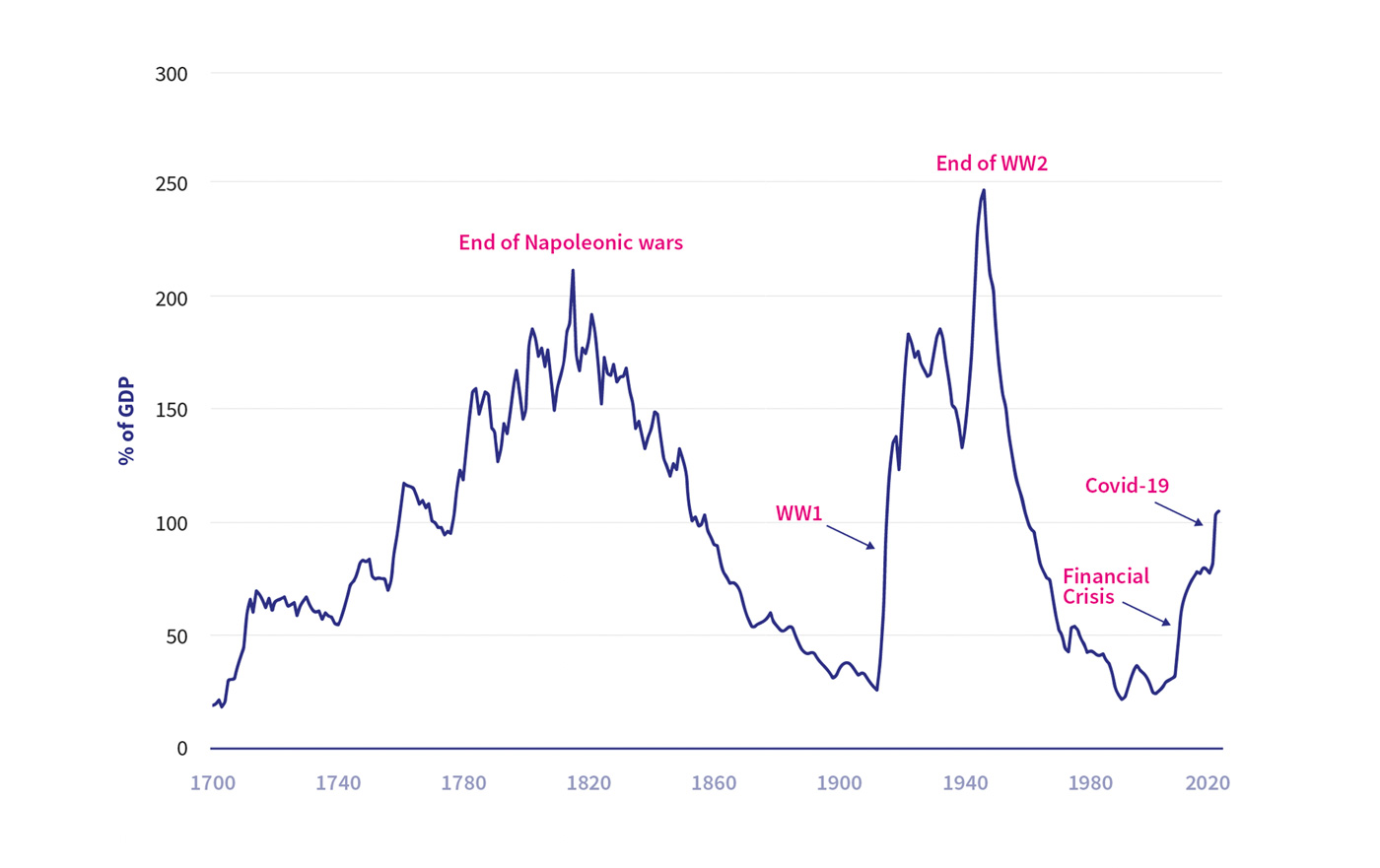

One of these is a rise in sovereign debt. At the turn of this century, public sector debt stood at 27% of the Gross Domestic Product (GDP). It is expected to peak at 98.2% of GDP this financial year.[2] Most of that seventy-percentage point rise took place in the space of just four years—during the financial crisis of 2007-8 and during the global pandemic of 2020-21. Moving forwards, the debt-to-GDP ratio may have to rise further to meet the continuing costs of the pandemic and the cost of living crisis facing households.[3]

A second challenge flows from the scale of public investment needed to make the transition to a net zero carbon economy and to ‘level up’ the UK regions. The OBR has estimated that, in an ‘early-action’ scenario, the cumulative investment costs of reaching net zero emissions could increase the public debt-to-GDP ratio by 20 percentage points (to 120%) by 2050. Failure to take action, on the other hand, could increase the ratio[4] to 289% by the end of the century.[5] The Centre for Cities has suggested levelling up the UK regions could turn out to be as expensive as the reunification of Germany, which cost and estimated €2 trillion (£1.7 trillion).[6]

A third emerging challenge lies in the potential costs of ‘servicing’ public debt in the face of inflationary pressures and rising interest rates. Over recent decades, the debt servicing costs of the government have fallen substantially—from 3.8% of the GDP in 1980/1 to 0.9% of the GDP in 2020/1—mainly as a result of a historical fall in real interest rates in an era of low inflationary pressure.[7] But there are uncomfortable indications that this may be about to change. Large increases in the price of food, oil, gas and electricity saw the Consumer Prices Index surge by 4.8% in the twelve months to December 2021.[8] In response to these pressures, the Bank of England has increased its policy interest rate from 0.1 percent to 0.25 percent. Further price rises are predicted, placing pressure on the Bank of England to raise interest rates further still.[9]

Inappropriate policy responses have the potential to reinforce these challenges in pernicious ways. Rising public debt ratios could squeeze the perceived ‘fiscal space’[10] for early investment in net zero, leading to much higher debt ratios later. Rising interest rates would increase the cost of borrowing, putting further pressure on the public purse and making private sector decarbonisation investments more expensive. Policy decisions to curb public spending could hold back investment in net zero and reduce social investment where it is most needed. Avoiding a ‘perfect storm’ of adverse conditions will require a clear-sighted and flexible approach to fiscal and monetary policy if social and environmental goals are to be navigated safely.

The aim of this briefing is to frame the macroeconomic context of these challenges and to argue against austerity and in favour of a new and essential ‘flexibility’ in framing fiscal and monetary policy for the post-pandemic era. The starting point for that exercise is a controversy around sovereign debt which has haunted macroeconomics for well over a decade.

Death by Numbers

Shortly after the financial crisis of 2007/8, two Harvard economists, Carmen Reinhart and Kenneth Rogoff, published what was to become a famous (and later infamous) paper about public debt. Growth in a Time of Debt found that while there is no obvious relationship between debt and growth when public debt-to-GDP ratios are below 90%, once these debt ratios exceed 90% median growth is around 1% lower and mean growth is around 4% lower (for advanced economies over the period 1946-2009).[11] Around the same time a group of economists known as the “Bocconi Boys”—a group of pro-austerity economists from University of Bocconi—published a series of papers[12] that took this idea a step further by arguing that cutting public spending could lead to an increase in economic growth. Both the Reinhart and Rogoff and the University of Bocconi papers appeared to provide strong support for—and certainly motivated—the emerging pro-austerity policies enacted by governments across the world in the years following the financial crisis.[13]

A couple of years later a 28-year old graduate student named Thomas Herndon was trying to replicate Reinhart and Rogoff’s findings using their original spreadsheet. When he couldn’t do it, he took the problem to his supervisor Robert Pollin, who told him to go back and try again. Still he failed. Eventually they discovered that the original analysis contained ‘coding errors, selective exclusion of available data, and unconventional weighting of summary statistics’. In short, the numbers were wrong. Once they had reworked the analysis, Herndon, Pollin and co-author Michael Ash concluded that the average growth rate for countries with debt to GDP ratios higher than 90% is ‘not dramatically different’ from that of countries with lower debt burdens.[14]

Since then, economists have weighed in on both sides of the argument. The International Monetary Fund (IMF) initially appeared to support the pro-austerity arguments of Reinhart and Rogoff and the Bocconi Boys, suggesting in 2013 that the most ‘critical fiscal policy requirements’ are a ‘persistent but gradual consolidation and, for the United States and Japan, the design and implementation of comprehensive medium-term deficit-reduction plans’.[15] Others continued to criticise these works, pointing out, amongst other things, that they lacked a coherent theory of sovereign currency[16] and that any correlation between high debt ratios and the economic growth rate could as easily support the reverse causality as the one the authors drew from it.[17]

The IMF later partly changed its position on the controversy. A paper published in 2013[18] argued that forecasters had significantly underestimated the value of fiscal multipliers in the period immediately after the financial crisis.[19] This in turn led them to underestimate the impact austerity policies would have on economic growth. Ultimately, the experience of countries during this period seemed to support this view, as those that engaged most actively in austerity policies also tended to have the slowest economic recoveries.[20] Following this, a paper published in 2014 concluded that there is ‘no magic threshold’ above which a nation’s debt dramatically compromises its medium-term economic prospects.[21] Instead, the impacts of debt depend inherently on a wide number of factors, including country conditions and on the fiscal and monetary frameworks in place.

Box 1: Crowding out and Ricardian Equivalence

Conventional economics puts forwards two primary reasons for why high public debt might lead to lower growth:

Crowding out: Crowding out refers to a situation in which debt issuance by the government increases the competition for funds on financial markets, which in turn pushes up the costs of borrowing to the private sector. As a result, it is argued that any positive impacts on output from the increase in public spending are at least partially offset by a reduction in private sector investment—so that public spending ‘crowds out’ private investment.

Ricardian equivalence: Ricardian Equivalence (RE) refers to a situation in which the private sector increases its saving in response to government borrowing, in anticipation of the government raising taxes in the future in order to repay the increased levels of debt.[22] Despite RE generally being considered to be less likely than crowding out, due to the unrealistic assumptions it requires to hold, it is important to note that RE type dynamics are at least partly built into many conventional economic modelling approaches.[23]

It is important to note that even though the theories of crowding out and Ricardian equivalence make up the conventional explanation of how increases in public debt might negatively affect economic growth, the theoretical and empirical validity of both theories is still contested, both within and outside of conventional economic circles. Crowding out, for example, is less likely when the short run interest rate is under the control of the central bank and money is endogenous, [24] as has long been argued by post-Keynesian economists and confirmed by the Bank of England.[25] Similarly, Ricardian equivalence relies on several assumptions, including perfect credit markets and infinitely lived households, that are unlikely to hold in reality.

More recently, a meta-analysis of the public debt/growth literature found that on average there is no relationship between public debt ratios and growth once the publication bias in favour of negative results is taken into account.[26] It would seem, therefore, that there is little evidence that current or moderately higher public debt ratios are likely to be bad for economic growth. Yet despite this, the general consensus within mainstream economics is still that public debt ratios above a certain threshold are likely to negatively impact economic growth in the longer run, due to either crowding out or Ricardian equivalence effects (see Box 1). There is, however, little agreement about where this threshold might be.[27]This may seem like an arcane dispute between warring economists about arbitrary numbers. But numbers have consequences. Nobel prize-winning economist Paul Krugman suggested that austerity politics was sold to the public under false pretences. The Reinhart and Rogoff results allowed politicians to insist that austerity was not a choice but an economic necessity. The evidence in support of that claim was flawed at best. ‘Policy makers abandoned the unemployed and turned to austerity because they wanted to,’ claimed Krugman. ‘Not because they had to.’[28]Numbers matter. Government responses to economic shock have a profound impact on society. In a detailed analysis of economic recovery across eight countries, Oxford economist David Stuckler and Stanford epidemiologist Sanjay Basu maintained that pro-austerity policies enacted to reduce fiscal deficits had a devastating impact on public health.[29] A recent study published in the British Medical Journal appears to confirm that finding for the UK. Austerity policies enacted in the wake of the financial crisis are estimated to have cost the lives of more than 57,000 people in this country between 2010 and 2014.[30] Stuckler and Basu conclude that such pernicious outcomes were entirely avoidable. ‘Even amid the worst economic disasters,’ they wrote, ‘negative public health effects are not inevitable: it’s how communities respond to challenges of debt and market turmoil that counts.’

That mistakes were made in the aftermath of the financial crisis is now barely in question. What remains at stake is how we should now respond, as the country emerges from the economic crisis caused by the coronavirus pandemic and seeks to address the profound challenge of combatting climate change and levelling up the regions. An informed position on the nature of fiscal spending, the role of the fiscal deficit and the sustainability of the public debt is vital to that task.

Sound and functional finance

It’s never particularly surprising to find economists disagreeing with each other. But there are reasons why the Reinhart and Rogoff affair struck such a powerful chord both inside and outside the economics profession. Principal amongst these is that it re-ignited a much longer running dispute between two radically opposed views on the role and effectiveness of fiscal spending and the responsibility of government to curb that spending when the public debt is high.

The argument goes back (at least) to John Maynard Keynes’ insistence that stimulus spending is essential in order to stabilise the economy in the face of an economic downturn. The same insight was echoed in Franklin D Roosevelt’s ‘New Deal’ in the US during the 1930s, one of the earliest and most extensive stimulus programmes on record.[31] They also inform more recent arguments in favour of a Green New Deal.[32]

Modern Monetary Theory (MMT) is one recent incarnation of this view. Borrowing from a school of thought known as post-Keynesian economics, it argues that governments should ‘set their fiscal position [i.e., decide their levels of taxation and spending] at whatever level is consistent with price stability and full employment, regardless of current debt or deficits’.[33] The economist Abba Lerner, writing in 1943, described this as ‘functional finance’.[34] Fiscal policy should be judged, he said, not on the basis of a particular number that emerges from the fiscal budget each year, but on the basis of how well government spending itself functions to deliver desired economic and social outcomes.

Not surprisingly, advocates of functional finance have been amongst the most vociferous opponents of austerity over the last decade. Though tempting as a strategy to bring down debt, they argue, austerity is not only unsavoury in terms of its social impacts but also in its economics ones as well. Cuts to government spending lead to reductions in private sector incomes and employment, which lead to further falls in spending, incomes and employment, and so on and so forth (the ‘multiplier’ effect). As a result, the overall financial impact of a cut in government spending (on GDP) can significantly exceed the original value of the spending reduction itself. This in turn can lead to the public debt ratio falling more slowly than anticipated (or not at all). In some cases, an attempt to cut the deficit can lead, perversely, to an increase in the public debt ratio.[35]

Functional finance stands in stark contrast to a mainstream view which Lerner called ‘sound finance’, in deference to the rules of sound finance that clearly apply to households and firms. As a household or a firm’s debt increases relative to its income, its ability to service this debt is diminished. Eventually, if its debt-to-income ratio becomes too large it will run the risk of default or foreclosure. Sound finance takes this logic and applies it to the public finances. Thus, it assumes that governments are only ever able to spend what they can raise in taxes or borrow from commercial markets. Borrowing is risky, because the government must rely on lenders periodically being willing to roll over their loans at an affordable interest rate—something they may become less willing to do the larger public debt ratio becomes. Thus, from a sound finance perspective, to avoid the risk of not being able to roll over its loans (and so the risk of default) the government should always aim to ‘balance its books’ over the business cycle and keep its debt ratio at a relatively low level.

Today, the ideas of sound finance live on via the belief (at least among certain economists and policymakers) that in the long run government debt-to-GDP ratios above a certain threshold can negatively impact economic growth. Hence, the modern interpretation of the sound finance position is that although fiscal policy is useful in emergency situations (but not for day-to-day economic management[36]), in the longer run it should primarily be used to reduce the public debt ratio to a ‘safe’ level. By doing so, fiscal policy prevents any negative impacts from high public debts and also creates ‘fiscal space’ which can be used to respond to the next crisis. There is, however, no agreement as to what constitutes a safe level, how quickly the debt ratio should be decreased after an emergency is over[37], or even whether debt to GDP ratios by themselves are useful indicators of fiscal space.[38]

The government is not a household

A key claim of functional finance (and post-Keynesian economics) is that the ‘government is not a household’. It can never ‘run out of money’ in the same way that a household or a firm can—so long as it issues its own sovereign currency. Further, because government is large relative to the size of the economy, government income is not independent of its spending—cuts in spending can lead to a reduction in economic activity, which then cause the tax take to be lower.[39] In her timely book The Deficit Myth, published during the early days of the global pandemic, US economist Stephanie Kelton describes the insight that the government can’t run out of money as a ‘Copernican shift’ away from the conventional view espoused by the sound finance model. Rather than chasing after the ‘misguided goal’ of a balanced budget, she argues, we should be ‘pursuing the promise of harnessing… public money, or sovereign currency, to balance the economy so that prosperity is broadly shared.’[40]

The claim that government can finance its spending via money creation has attracted a good deal of anger and sometimes ridicule from conventional economists and politicians. In a speech to the Conservative Party Conference in 1983, Margaret Thatcher once declared that ‘if the state wishes to spend more it can only do so by borrowing your savings or by taxing you more. And it’s no good thinking that someone else will pay. That someone else is you.’ In direct contrast to the functional finance, she insisted ‘there is no such thing as public money. There is only taxpayers’ money.’[41]

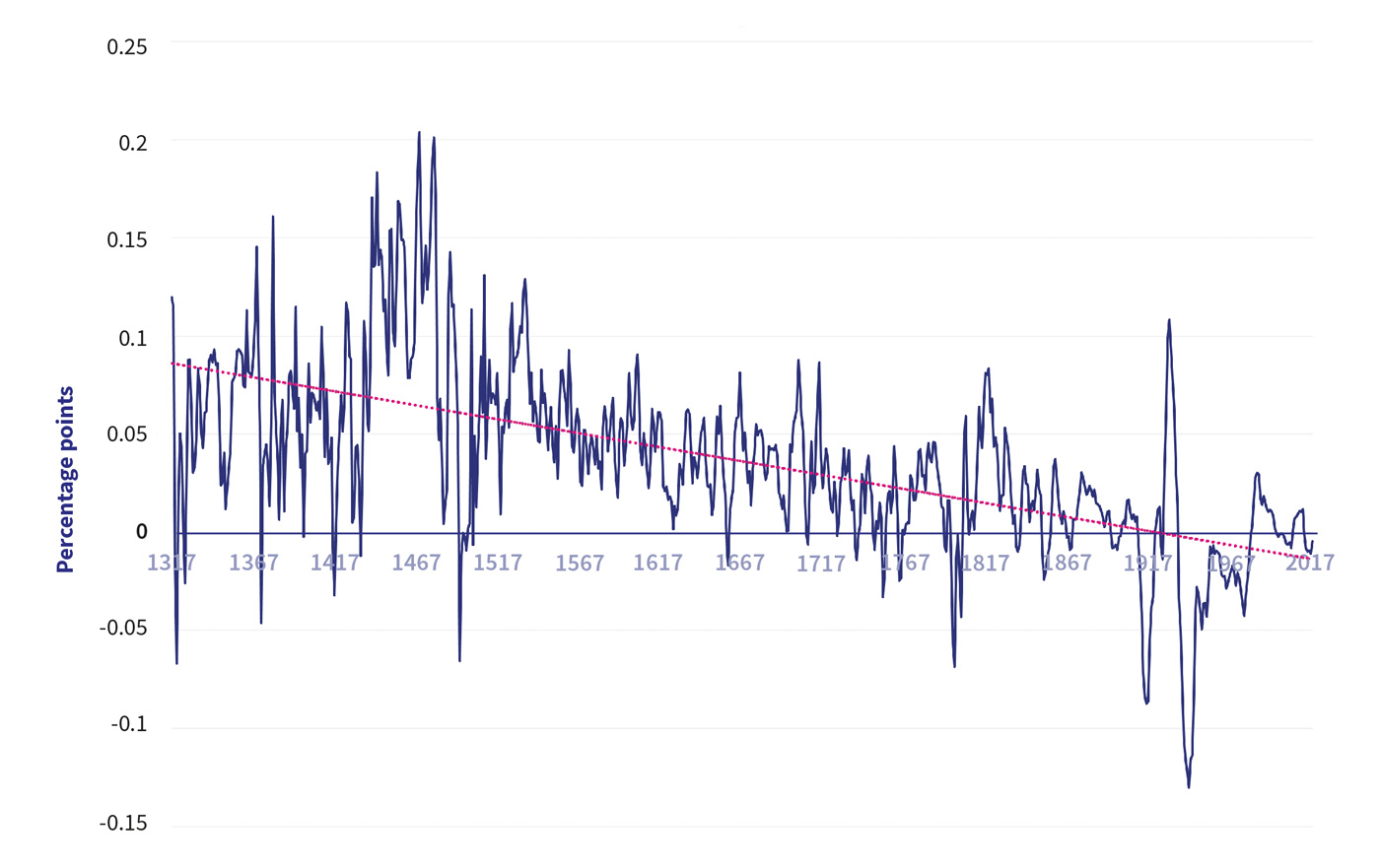

Three decades later, an unkind meme was to cast MMT as an acronym for the ‘Magic Money Tree’ from which, according to legend, it’s possible to spend at will. In response to requests to find the means to increase nurses’ pay, former British Prime Minister Theresa May famously employed this meme, declaring: ‘there is no Magic Money Tree’.[43] But this position was lampooned by those that recognised that the (at that point) £445 billion in mostly government bonds the central bank had purchased since the financial crisis by creating central bank reserves was a process (almost) as close to unfettered sovereign money creation as it is possible to find.The heat generated by the claim the government can’t run out of money can be unhelpful to policy-makers trying to shed light on complex macroeconomic debates about fiscal policy, deficits and the public debt. Even as we recognise that the current level of UK public debt remains relatively low by historical standards (Figure 1), it remains important to understand to what extent these claims and counter-claims are valid.To leave policy-making to ideology is to risk floundering in the ‘perfect storm’ to which we alluded at the outset. In the remainder of this briefing we attempt a nuanced view of the opposing arguments—identifying where the conflicting theories of sound and functional finance meet in practice and where they offer pragmatic guidance for fiscal and monetary policy in the post-pandemic era.

Beyond the Magic Money Tree

Perhaps the most surprising aspect of the debt controversy is that its most contentious claim turns out to be more or less true; but recognising this does not in itself resolve the controversy. There is a money tree. But it’s not necessarily magic.

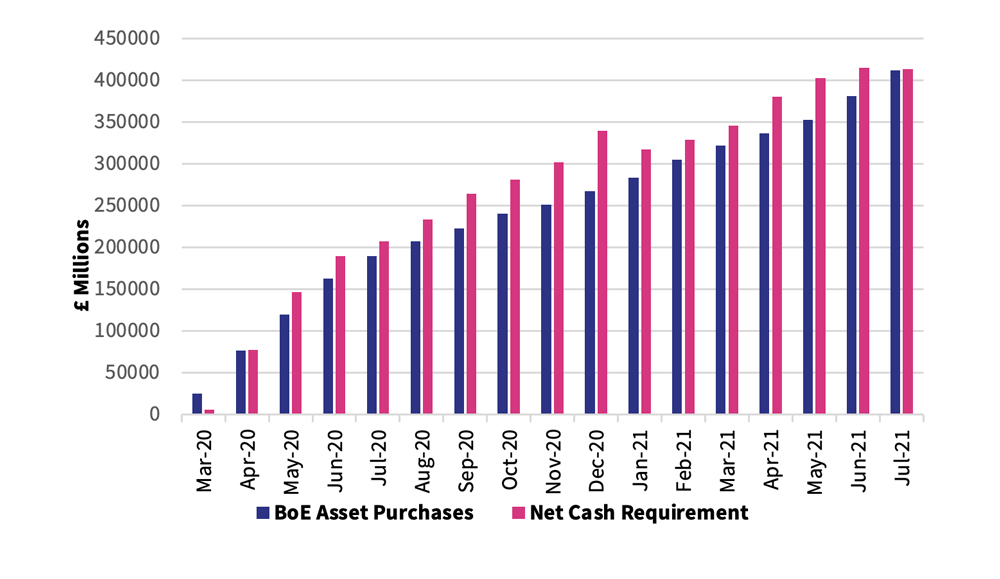

A government which issues its own sovereign currency can always issue more of it, more or less at will. During the last two years both the Bank of England and the US Federal Reserve have used this ability extensively—and creatively—to bankroll their respective governments’ Covid-19 rescue packages (Figure 2). The ECB has done the same in Europe.

In the US, the Fed announced on March 23rd 2020 that it would be willing to buy unlimited amounts of Treasury bonds to support ‘smooth market functioning.’ Four days later, Congress passed the Coronavirus Aid, Relief and Economic Security (CARES) Act committing the government to a $2.2 trillion stimulus package. Since that time, the Fed has disbursed $3.7 trillion from a possible $6.75 trillion support programme and in the process absorbed almost all the new US debt that the government has issued.[44]

On the 19th March 2020, three days after the UK entered its first coronavirus lockdown, the Bank of England’s Asset Purchase Facility (APF) issued an inconspicuous ‘market notice’ following a special meeting of the Monetary Policy Committee (MPC).[45] Its impact was the UK equivalent of the Fed’s announcement. The MPC was decidedly more cautious than the Fed in the scale of its operations at that point, offering a further reduction in the Base Rate and an extension of its quantitative easing (QE) programme—buying government and corporate bonds on the secondary bond market.

But the APF’s ‘market notice’ also contained a commitment to ‘keep under review the case for participating in the primary market’. This somewhat arcane pledge demonstrated an unexpected willingness to purchase bonds directly from the Treasury rather than from the secondary market—something that had been outlawed by the EU’s Maastricht Treaty and considered too risky under the sound finance model for decades. A few weeks later the Treasury and the Bank announced an agreement to ‘temporarily extend’ the government’s Ways and Means account at the Bank—effectively an overdraft facility—providing a similar capability for government to spend as and when it needed.[47] It sounded innocuous. But it was a significant step towards acknowledging the ability of the Bank directly to finance government spending.What happened during the Covid-19 lockdown amounted to a further rolling back of the principles of sound finance that had begun already in 2008. A former chief economist of the asset management company Pimco described it as ‘an epic moment’ signalling a ‘breaking down’ of the ‘church-and-state separation of the fiscal and monetary authority’. Kelton argues that it was simply a revelation of what was already the case. A government that issues its own sovereign currency can always issue more of it. The New York Times talked about it as the removal of a fig leaf.[48] But behind the fig leaf lie three potential problems. None are unsurmountable. But they have to be taken seriously.

The perils of ‘printing money’

The first issue with financing spending by money creation is that the power could potentially be abused by government, leading to excess demand and inflation. A second is that money creation can push up the prices of financial assets and lead to increase in wealth inequality. A third is that increasing public funding by money creation can increase the speed with which changes in interest rates affect government debt payments.

Inflation

Perhaps the most obvious issue—the one that is immediately raised by opponents of financing spending via money creation and forms the basis for the conventional separation between Bank and Treasury—is the danger of inflation, perhaps even hyperinflation, if governments are able to ‘print’ all the money they need. This concern is of course heightened in a period of rising background inflation such as the one currently being experienced.

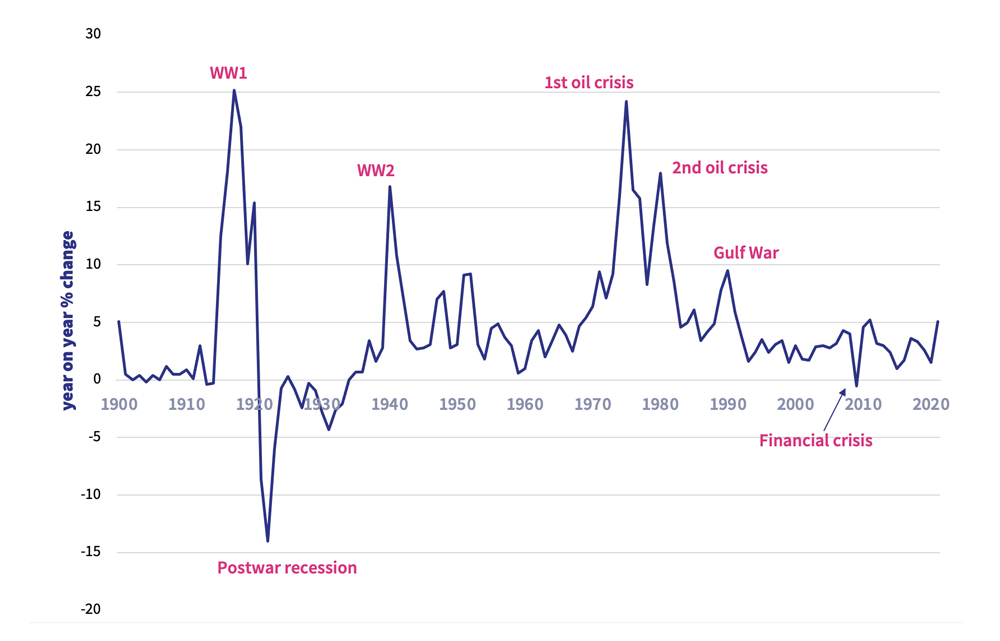

The Office for National Statistics describes current price rises as ‘temporary’. And it is clear that, in spite of recent increases, inflation is not particularly high in historical terms (Figure 3). What’s more, the inflationary pressures are in large part the result of increases in energy prices and disrupted supply chains, neither of which an increase in interest rates will do much to address. However, the concern amongst policy makers is that these price rises might eventually feed through into higher wage demands, which could then lead to further price increases, and in turn generate a wage price spiral (even though stagnant wages are currently a concern[50]). Were this to happen, the central bank would most likely increase interest rates, with knock on effects for debt servicing costs. We address this concern below.Aside from these contemporary concerns, there is a conventional ‘wisdom’ which argues that the political incentives to abuse the money creation power are high. And the impacts, in the worst case scenarios, are potentially disastrous. With excessive spending by government, the danger is that prices will eventually rise.Yet there is little evidence that these risks are likely to manifest themselves, unless the power to create money is abused by the government. Historically these abuses have happened, most famously under the Weimar Republic in Germany during the 1920s and in Zimbabwe in the mid to late 2000s. In Zimbabwe these abuses were mostly a response to the complete collapse of the domestic economy that itself came about because of systematic clientelism and corruption in government.[51] Conversely, other instances of large scale money creation by governments—most notably the quantitative easing schemes that have been undertaken in Japan since the early 2000s, and a large number of other countries since the 2007-08 financial crisis—have not led to even moderately high levels of inflation. Excessive inflation would therefore seem to be the result of the abuse of the money creation power in the face of a collapsing economy, rather than a direct consequence of money creation that is undertaken with a view to its economic effects—including on inflation.

Asset prices and inequality

The second pitfall of financing spending by money creation is a curious one. It has to do with the way in which central bank money creation is implemented. However, as we will see, the criticism is more valid of the current approach to money creation—specifically quantitative easing (QE)—than it is to spending directly financed by money creation.

Almost all of the QE in which the Bank of England has engaged in since 2008 has been achieved by purchasing existing assets (government and corporate bonds) on secondary markets in exchange for central bank reserves. In total, QE has replaced £875 billion worth of long-term government bonds (over a third of the public sector debt), attracting an interest rate of around 2%, with central bank reserves which are subject to an interest rate of only 0.25%. According to the OBRs latest data, the impact of this has been to reduce government interest payments by an estimated £16.5 billion in 2020-2021 and £132 billion since the QE programme began.[52]

Along with these interest savings for government, QE has a number of other benefits. Reserves are highly liquid risk-free assets, whose ownership by financial institutions can sometimes be preferable to less liquid and riskier loans. The increased supply of central bank reserves drives down the overnight lending rate and lowers the cost of borrowing throughout the economy. And the increase in asset prices made people and businesses feel wealthier, which leads to an increase in economic activity.

QE therefore looks like a win all round. At the time of the financial crisis, banks were generally very happy with QE. And in improving their balance sheets banks also improved their share prices—and indeed their remuneration packages—in ways that might otherwise have been impossible.

But QE also created some problems, as a recent House of Lords inquiry has pointed out. In its current incarnation QE ‘is reliant on a series of transmission mechanisms that operate primarily in and through financial markets’, concluded the Economics Affairs Committee.[53] The impacts of these mechanisms on the borrowing costs, liquidity and solvency of banks may be clear enough. But the inquiry was sceptical about the longer-term impacts on the real (non-financial) economy. It was particularly troubled by the evidence that QE has increased wealth inequalities over the years that it has been operating. Wealth inequalities are higher in the UK than income inequalities and have been rising since the financial crisis.[54]

One of the declared aims of QE is to push up asset prices, improving the balance sheets of both financial and non-financial institutions. In a world in which the distribution of assets were perfectly equal, this would not matter. We do not live in such a world. Inflating or even underpinning asset prices in a world where the livelihoods of ordinary workers are threatened has the potential for perverse outcomes. The Economic Affairs Committee argued that the ‘mechanisms through which quantitative easing effectively stabilised the financial system following the global financial crisis have benefited wealthy asset holders disproportionately by artificially inflating asset prices’.[55]

Could it be otherwise? Is it possible to devise interventions by the central bank and treasury that use the money creation power to directly affect the incomes of households, firms, and other enterprises? The answer is clearly yes. However, it would involve the central bank directly financing government spending, when appropriate, rather than simply buying already issued bonds on the secondary markets. That is, it would involve monetary policy being used in coordination with fiscal policy, rather than on its own. Some creative innovations along these lines were introduced during the pandemic. Further innovations could include financing direct grants to households with money creation (by having the central bank buy newly issued bonds from the government, before transferring this money to households). ‘Helicopter money’ in the more traditional sense. A more radical approach would be to allow citizens to hold accounts at the central bank, and then transfer money to these accounts in the same way. The idea of allowing citizens to hold accounts at the central bank has some surprising advocates. In 2018, The Economist wrote in favour of the idea, arguing that it could improve both consumer welfare and macroeconomic policy.[56]

The speed of the pass-through and debt sustainability

A third pitfall of financing spending via money creation relates to its impact on the speed of the pass-through—i.e., the speed with which a change in interest rates feeds through to impact the interest payments on government debt.

As discussed above, quantitative easing replaced £875 billion worth of long-term government bonds with central bank reserves. While this action did significantly reduce the interest costs on government debt, it also increased the speed with which changes in interest rates pass through and affect the interest payments the combined government sector (central government and the central bank) makes to the private sector. For example, before the 2007/08 financial crisis, only around a sixth of the total impact on interest payments from an increase in interest rates occurred within a year. Conversely, today (after QE) approximately half of the impact of an increase in interest rates on interest payments by the government occurs within a year.[57]

This increase is a direct consequence of QE and the way in which the central bank conducts monetary policy. When the central bank changes interest rates the interest rate (and so the interest payments) on central bank reserves changes instantaneously. Conversely, the interest payments (the coupon) on bonds are not affected. It is only when the government issues new bonds (perhaps because it is rolling over its debts) that its interest costs change. Hence, by engaging in quantitative easing (and so replacing bonds with reserves) the combined government sector (central government and the central bank) has swapped out a liability whose interest rate only changes when it is rolled over to one that changes instantaneously. As a result, since QE started the median maturity of public sector’s consolidated liabilities (mainly bonds and central bank reserves) has been reduced from seven to two years,[58] which has in turn increased the average speed of the pass-through.

An increase in the pass-through doesn’t really matter if interest rates remain low. However, the principal remit of the central bank is to achieve price stability by controlling the interest rate—the cost of borrowing money and servicing debt. Because of the reduction in the pass-through, a swift and sudden increase in interest rates rise could lead to escalating servicing costs and spiralling debt. An important question is therefore whether current inflationary pressures will eventually force the Bank of England to increase interest rates.

In the longer term, the sustainability of the public debt (see Box 2) tends to be driven by the difference between the rate of return ‘r’ on ‘safe’ assets like government debt and the rate of economic growth ‘g’ in the economy. When r is consistently greater than g, debt servicing costs exceed the growth rate of the economy. As a result, even if the government is running a balanced primary budget the debt-to-GDP ratio will escalate.[59] Conversely, when r is less than g, debt servicing costs remain manageable and the debt-to-GDP ratio (eventually) stabilises.

An example of this dynamic can be seen in the UK between 1945 and 1980. Despite the government budget being in deficit for most of this period, the debt-to-GDP ratio significantly decreased, from over 250 per cent of GDP in 1945 to less than 50 per cent in 1990 (Figure 1). This reduction in the public debt-to-GDP ratio was largely due to growth being above the interest rate, which more than offset the negative impacts on the debt ratio from the deficit.

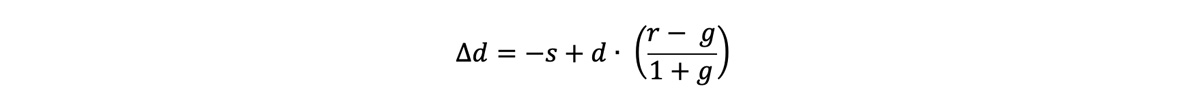

Box 2: Debt Sustainability

Public debts are said to sustainable when economic conditions will cause them to stabilise at some given debt-to-GDP ratio. Conversely, public debts are said to be on an unsustainable trajectory when conditions will cause them to rise without limit.[60] The conditions under which the public debt ratio can be said to be sustainable or unsustainable is captured in the following formula:

Where d is the debt-to-GDP ratio, s is the primary surplus-to-GDP ratio, r is the real interest rate on government liabilities and g is the real growth rate.[61]

Where d is the debt-to-GDP ratio, s is the primary surplus-to-GDP ratio, r is the real interest rate on government liabilities and g is the real growth rate.[61]

One way of thinking about this equation is that it says that when the real interest rate is equal to the real growth rate (when r = g), then the change in the debt-to-GDP ratio will be equal to the change in the primary surplus-to-GDP ratio (∆d = – s). Equivalently, when the government’s primary budget is in balance (when -s = 0), the change in the value of the debt-to-GDP ratio depends on the difference between the real interest and growth rates. For illustrative purposes, we can consider the following two examples:

Example 1—the real growth rate is above the real interest rate (g > r): In this scenario, the positive impact on the debt ratio due to the real interest is more than offset by the negative impact on the debt ratio due to the growth rate. Consequently, the government is able to run a primary deficit (equal to d * [(r – g) / (1 + g)] ) without increasing its debt-to-GDP ratio (a deficit smaller than this would cause the debt ratio to fall). And, even if the government does run a primary deficit larger than this value, the debt-to-GDP ratio will eventually stabilise at a particular debt ratio. Hence, when g > r, the debt ratio is said to be on a sustainable trajectory.

Example 2—The real growth rate is below the real interest rate (g < r): In this scenario, the positive impact on the debt ratio due to the real interest rate is not offset by the negative impact on the debt ratio due to the real growth rate. Consequently, the government must run a primary surplus (equal to d * [(r – g) / (1 + g)] ) to prevent its debt-to-GDP from increasing. The failure to consistently run a surplus of this size will see the public debt ratio increase without limit. Hence, when g < r the debt ratio is said to be on an unsustainable trajectory. Crucially, the larger the debt-to-GDP ratio the larger the primary surplus that stabilises the debt ratio, given r – g. Hence, when the current debt-to-GDP ratio is large, even small changes in r or g can lead to a large changes in the value of the primary surplus that is required to stabilise the debt ratio. This is particularly important given that public debt ratios are currently increasing due to the ongoing pandemic and are likely to increase even more in future to fund the transition to net zero.

An important question is therefore whether interest rates are likely to remain below growth rates moving into the future. In the short run, a significant increase in interest rates is only likely if economic conditions also improve—limiting the extent to which interest rates are likely to exceed growth rates. Over the longer run, very long run trends suggest that (on average) interest rates are likely to remain below growth rates. Indeed, a Bank of England paper recently undertook a fascinating calculation of the historical value of r – g over the course of more than seven centuries (Figure 4) and concluded that there is what they called a ‘supra-secular’ declining trend in r – g in which r has been less than g (on trend) for almost a century.

Whether this trend continues or not, the fundamental point remains true. For as long as it is possible to control the interest rate on public debt, there is little risk of an uncontrollable rise in debt servicing costs. But to achieve this, as we shall see, requires careful attention to the framing of both fiscal and monetary policy.

Sound and Functional Finance

The previous sections of this paper identified two different approaches to fiscal policy—orthodox (sound finance) and post-Keynesian (functional finance). Sound finance emphasises the potential negative impacts of public debts on the economy, and the risks to the trajectory of the public debt ratio from changes in economic conditions. This view in turn leads to the recommendation that fiscal policy be used to reduce public debt to a ‘safe’ level over the medium run. There is, it is argued, no alternative to fiscal discipline and credibility in ‘good times’ to create the fiscal space—i.e., room for further borrowing—that is necessary for the ‘bad times’. The argument that there is no alternative, however, rests in part on the assumption that the targets of monetary and fiscal policy cannot be reassigned.

Under a ‘sound finance’ regime, an operationally independent monetary policy is assigned to a demand management (a price stability/output target), which it attempts to achieve via its control over the short-term interest rate, while fiscal policy is assigned to a debt management target. Assigning the targets in this way does make a certain degree of sense when the public debt-to-GDP ratio and the speed of the pass-through are relatively low (as they were when monetary policy was first made independent), because changes in interest or growth rates will not quickly or significantly affect the overall value of government expenditures or the sustainability of the public debt. However, as the public debt ratio becomes larger and the pass-through becomes quicker, the impact of a change in interest rates or growth rates also increases. That is, the higher the public debt ratio, the more vulnerable the government’s fiscal position becomes to a change in economic conditions (because, starting from a position in which the public debt ratio is stable, a given increase in real interest rates or a reduction in real growth rates will require a larger reduction in the primary deficit/increase in the primary surplus in order to stabilise the debt ratio). Hence, from an orthodox perspective (and in a sound finance regime) the larger is the public debt ratio the more it makes sense for the government to try to build up fiscal space by cutting spending and/or increasing taxes.

However, it is not necessarily the case that monetary policy needs to be assigned to demand management and fiscal policy to debt management. A functional finance regime, for example, allocates to fiscal policy the task of demand management (by setting government spending and taxation to keep economic activity at a desired level). Monetary policy can then be allocated to an alternative target, such as managing debt sustainability (by mostly keeping the interest rate below the growth rate). By allocating the targets in this way a functional finance regime avoids the need for governments to engage in austerity to build up fiscal space: keeping interest rates low prevents debts from rising unsustainably. Thus, there is an alternative to pursuing a policy of fiscal space that will also prevent unsustainable increases in the public debt ratio, but it requires the targets of monetary and fiscal policy to be reassigned.

Interestingly, recent research from two economists from the Institute for New Economic thinking, Arjun Jayadev and J. W. Mason, suggests that a functional finance regime may even become more effective as a tool to manage the economy (and sound finance regime less effective) the larger is the public debt-to-GDP ratio. They find that monetary policy becomes progressively less effective at stabilising output the higher is the public debt ratio, as the larger is the debt ratio the larger is the impact an increase in interest rates has on government expenditures (and therefore the more the government will have to cut spending in order to prevent the debt ratio from increasing).[63] Conversely, they find that fiscal policy is always able to stabilise output regardless of the level of public debt, so that the case for functional finance actually increases the larger is the public debt ratio (while the case for sound finance decreases). Thus, they argue that the orthodox view that fiscal policy should be used to create ‘fiscal space’ when the public debt ratio is high gets the relationship between fiscal policy and debt back to front. Instead, they contend that the higher the debt ratio the more government should use countercyclical fiscal policy to attempt to stabilise output rather than the interest rate.

The case for greater coordination of fiscal and monetary policy can be further strengthened by looking at the historical record. In their paper, Jayadev and Mason point to the post World War II era in the US as an example of when monetary policy was used to keep government borrowing costs down while fiscal policy was used to stabilise demand. More generally, between 1946 and the 1980s public debts ratios in advanced economies fell from historically high to historically low levels. These reductions were not, however, the result of governments running large surpluses year on year, decade on decade, but because real growth rates were (on average) above real interest rates.

It is also interesting to consider the conditions under which monetary policy was made operationally independent, and what this says about the case for the coordination of fiscal and monetary policy. In the UK, monetary policy became operationally independent from the Treasury in 1997. There were a number of reasons for this, many of which were related to the thinking in orthodox economic circles at the time.[64] What made the separation viable, however, was the historically low public debt levels. As a result, even relatively large changes in interest rates by the central bank had relatively minimal effects on the overall level of government spending. This allowed monetary and fiscal policy to be conducted independently of each other, and served an ideological separation between Bank and State, but prevented coordination between them.

Today, the higher public debt to GDP ratio means the opposite is true. Indeed, in a recent fiscal risks report, the Office for Budget Responsibility found that at increase in interest rates of just 2.5 percentage points would lead by 2050 to net interest payments increasing from 1 to 5 percent of GDP and from 2.7 to 13.2 percent of revenues (their highest level since 1946-47), which would in turn cause the public debt ratio to increase to 139 percent. In order to stabilise this debt ratio at the higher interest rate (as advocated by the sound finance approach), government would need to reduce its spending by 2 percent of GDP—an amount equivalent to the entire defence budget in 2020-21.[65]

Thus, under a sound finance regime the decision by the central bank to increase rates can lead to significant cuts to government spending. That is, the central bank (monetary policy) tail can end up wagging the central government (fiscal policy) dog. It is therefore perhaps not surprising that monetary policy was made operationally independent from fiscal policy during a period in which public debt ratios were at historically low levels. Equivalently, the higher public debt to GDP ratios of today call into question the practicality of central bank independence and the targets to which fiscal and monetary policy are currently allocated.

A call for ‘Flexible Finance’

The key point to take from the above is that as long as the public debt-to-GDP ratio is relatively low, the independent operation of monetary policy by the central bank will not have a significant impact on the operation of fiscal policy by the treasury. However, as the public debt ratio increases, so to do the feedback effects of changes in the interest rate on public debt sustainability. Thus, the targets to which monetary and fiscal policy are allocated and the operational independence of monetary policy become less and less appropriate the larger the public debt-to GDP ratio becomes. Crucially, the public debt ratio is likely to remain high (and may even increase further) over the coming decade.[66]

By itself, this is unlikely to be a problem—there is little evidence that current public debts ratios are likely to negatively affect economic growth. However, to the extent that the government wants to prevent its debt ratio from increasing further, larger debt ratios can constrain government action—as an increase in interest rates reduces the deficit the government is able to run without increasing its debt ratio. And if interest rates increase above the growth rate, then the government will have to run a surplus to prevent its debt ratio from increasing. Thus, as long as monetary policy is used for demand management and the government cares about debt sustainability, the government’s fiscal stance is made subservient to monetary policy actions of the central bank.

The current arrangement, however, is not the only possible way of organising monetary and fiscal policy. If instead fiscal policy takes on the role of managing demand and monetary policy takes on the role of debt sustainability, then fiscal policy becomes proactive while monetary policy becomes reactive. Crucially, this arrangement allows the government to maintain debt sustainability and continue to pay for the post pandemic recovery and the transition to net zero, without needing to engage in economically, socially, and environmentally damaging austerity measures.

Our principal call here is therefore for fiscal policy to take a more active role in managing economic activity, and for monetary policy to take consideration of public (and indeed private) debt sustainability issues when setting interest rates. This is not the same thing as allocating demand management only to fiscal policy, and debt sustainability only to monetary policy. Rather we are arguing that there needs to be a greater degree of flexibility and fluidity in the use of monetary and fiscal policy, the targets to which they assigned, and the degree of coordination between them. That is, the decision on whether monetary or fiscal policy should be applied to a particular target should depend on the economic conditions and needs of that time.

For instance, take the case where the economy is operating at below full capacity. In this situation, the government could engage in either a fiscal stimulus, a monetary stimulus, or some combination of the two. If private debts or asset prices are considered to be too high, then it may be appropriate that fiscal policy takes a more active role than monetary policy in stimulating demand. Alternatively, if the private sector is considered to have a relatively low debt to income level, then it may be appropriate to weigh the intervention more heavily in favour of monetary policy.

We can also consider a situation in which the economy is overheating so that the government wants to engage in some type of monetary and/or fiscal contraction. If public (and/or private) debts are relatively low, then an increase in interest rates might be an appropriate response to this situation. If, on the other hand, the public (and/or private) debt ratio is high, and the fiscal position is such that an increase in interest rates will require a cut in spending if the public debt ratio is not to increase any further, an increase in interest rates may be less appropriate. Instead, the government may want to lean more heavily on fiscal policy to reduce demand, in order to avoid a double contraction due to higher interest rates and cuts to government spending.

In addition to a greater degree of coordination between monetary and fiscal policy, there may also be a role for more unconventional monetary policy actions in managing demand. The central bank could, for example, use credit guidance tools to curb or stimulate bank lending to specific sectors or for specific activities.[67] Such an approach would allow the central bank to affect economic activity without altering interest rates—something that may be useful when public debts are high. Alternatively, the central bank could move to a ‘tiered renumeration scheme’ on central bank reserves to reduce the quantity of central bank reserves that pay interest. Doing so could significantly reduce the pass-through from changes in interest rates to government interest costs, and so allow the central bank to increase interest rates without damaging government debt sustainability.[68]

Whether or not these types of unconventional monetary policy are put into use or not, one thing is clear. The current monetary and fiscal policy regime was designed for a world of low public debt ratios that is very different to the world of today. Further changes in economic conditions—and increases in public debt—are likely as the economy recovers from the damage wrought by the pandemic and transitions to net zero. As a result, the current monetary and fiscal policy regime is no longer fit for purpose and may end up hampering both the recovery from the pandemic and the transition to net zero. Moving forwards, a more flexible and coordinated approach to monetary and fiscal policy will be required so that we can meet our environmental and social goals.

Conclusion

This briefing paper has explored the evidence and arguments surrounding the debt controversy that has haunted macroeconomic for decades and is critical in navigating the challenges of investing in a just transition to a net zero economy on a timescale short enough to maintain a decent chance of remaining within 1.5 degrees global warming.

We have identified two apparently contrasting positions characterised by orthodox macroeconomic policy (sound finance) and post-Keynesian theory (functional finance). A key claim from the latter is its assertion that a government which issues its own sovereign currency can never ‘run out of money’. We find in favour of that claim. But we also acknowledge that this does not imply that the government should necessarily finance itself by creating money. Instead, the method of financing chosen should depend on its economic effects and the needs of the economy at that point in time.

Our principal call here is for a greater degree of flexibility in the use of both monetary and fiscal policy and for better coordination between them. That flexibility should extend not only to the appropriate allocation of the respective targets of price stability and debt sustainability, but also to the precise mandates of the institutions involved in delivering those targets and the mechanisms through which they are achieved. In particular, these targets, mechanisms and mandates cannot be divorced from the urgency of meeting the environmental and social goals ahead.

One thing is clear. A return to a punitive austerity driven by outdated and rigid forms of monetary and fiscal policy would be disastrous right now. Ideological claims to prior authority cannot possibly guide us through the complexity of the challenges we are facing in the post-pandemic era.

References

Alesina, A. and Ardagna, S., 2010. Large changes in fiscal policy: taxes versus spending. Tax policy and the economy, 24(1), p.35-68.

Alesina, A., 2010, April. Fiscal adjustments: lessons from recent history. In ECOFIN meeting, Madrid, April (Vol. 15, p.1909-1940).

APPG, 2018. Beyond Redistribution—confronting inequality in an era of low growth. [online]. APPG on Limits to Growth. AETW Working Paper no 2. Available at: https://limits2growth.org.uk/publication/aetw_no2/attachment/appg_pp2-header/. [Accessed 19 January 2022].

Armstrong, P., 2018. Where does the Magic Money Tree Grow? Gower Initiative for Modern Money Studies Blog. Available at: https://gimms.org.uk/2018/12/28/magic-money-tree/. [Accessed 19 January 2022].

Bank of England, 2017. A Millennium of Macroeconomic Data. [online]. Bank of England. Available at: https://www.bankofengland.co.uk/statistics/research-datasets; [Accessed 19 January 2022].

Bank of England, 2020a. Asset Purchase Facility (APF): Asset Purchases and TFSME—Market Notice 19 March 2020. [online]. Available at: https://www.bankofengland.co.uk/markets/market-notices/2020/apf-asset-purchases-and-tfsme-march-2020. [Accessed 19 January 2022].

Bank of England, 2020b. HM Treasury and Bank of England announce temporary extension to Ways and Means facility. [online]. Available at: https://www.bankofengland.co.uk/news/2020/april/hmt-and-boe-announce-temporary-extension-to-ways-and-means-facility. [Accessed 19 January 2022].

Barro, R. J., 1974. Are Government Bonds Net Wealth?. Journal of Political Economy, 82(6), 1095-1117.

Barro, R. J., 1976. Perceived wealth in bonds and social security and the Ricardian equivalence theorem: Reply to Feldstein and Buchanan. Journal of Political Economy, 84(2), 343-349.

Bezemer, D., Ryan-Collins, J., van Lerven, F., and L Zhang, 2021. Credit policy and the ‘debt shift’ in advanced economies. Socio-Economic Review. Available at: https://doi.org/10.1093/ser/mwab041

Blanchard, O. and Perotti, R., 1999. An empirical characterization of the dynamic effects of changes in government spending on output. NBER Working Paper, 7296, p.101-106.

Blanchard, O.J. and Leigh, D., 2013. Growth forecast errors and fiscal multipliers. American Economic Review, 103(3), p.117-20.

Breuer, C., 2019. Expansionary Austerity and Reverse Causality: A Critique of the Conventional Approach. Institute for New Economic Thinking Working Paper Series. Institute for New Economic Thinking.

Buiter, W., 2020. Central Banks as Fiscal Players: The Drivers of Fiscal and Monetary Policy Space. Cambridge University Press.

Cherif, R. and Hasanov, F., 2018. Public debt dynamics: the effects of austerity, inflation, and growth shocks. Empirical Economics, 54(3), p.1087-1105.

COVID Money Tracker, 2022. COVID Money Tracker. [online]. Available at: https://www.covidmoneytracker.org. [Accessed 19 January 2022].

Financial Times, 2021. Investors crank up best on UK interest rate rises. [online]. Available at: https://www.ft.com/content/1c0d0da5-2db8-4ec2-a577-0542317426c3. [Accessed 19 January 2022].

Fragetta, M. and Tamborini, R., 2019. It’s not austerity. Or is it? Assessing the effect of austerity on growth in the European Union, 2010-15. International Review of Economics and Finance, 62, p.196-212.

Future Hindsight, 2020. How Keynes Influenced FDR’s New Deal. [online]. Available at: https://www.futurehindsight.com/how-keynes-influenced-fdrs-new-deal/. [Accessed 19 January 2022].

Galbraith, 2011. Is the Federal Debt Unsustainable?. Levy Economics Institute Policy Note. The Levy Institute.

Galí, J., López-Salido, J. D., and Vallés, J., 2007. Understanding the effects of government spending on consumption. Journal of the European Economic Association, 5(1), 227-270.

Giles, C., and Stubbington, T., 2021. Investors sceptical over Bank of England’s QE programme. [online]. Available at: https://www.ft.com/content/f92b6c67-15ef-460f-8655-e458f2fe2487 [Accessed 19 January 2022].

Guajardo, J., Leigh, D., and Pescatori, A., 2010. Will it hurt? Macroeconomic effects of fiscal consolidation. IMF World Economic Outlook. International Monetary Fund.

Guajardo, M.J., Leigh, M.D., and Pescatori, M.A., 2011. Expansionary austerity new international evidence. International Monetary Fund.

Heimberger, P., 2021. Do Higher Public Debt Levels Reduce Economic Growth? The Vienna Institute for International Economic Studies.

Herndon, T., Ash, M. and Pollin, R., 2014. Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff. Cambridge journal of economics, 38(2), p.257-279. Available at: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.641.3345andrep=rep1andtype=pdf

House Budget Committee, 2012. The Path to Prosperity: A Blueprint for American Renewal.

House of Lords, 2021. Quantitative Easing—a dangerous addiction. House of Lords Economic Affairs Committee. HL Paper 42. Available at: https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4205.htm.

IMF, 2013. Hopes, Realities, Risks. World Economic Outlook 2013. International Monetary Fund. Available at: https://www.imf.org/en/Publications/WEO/Issues/2016/12/31/Hopes-Realities-Risks.

IMF, 2018. Assessing fiscal space: an update and stocktaking. IMF policy paper. International Monetary Fund.

Jayadev, A. and Konczal, M., 2010. The boom not the slump: The right time for austerity. Economics Faculty Publication Series. Paper 26. Available at: http://scholarworks.umb.edu/econ_faculty_pubs/26.

Jayadev, A., and Mason, J. W., 2018. Mainstream Macroeconomics and Modern Monetary Theory: What Really Divides Them?. Institute for New Economic Thinking working paper. Institute for New Economic Thinking.

Jobst, A. and Lin, H., 2016. Negative interest rate policy (NIRP): implications for monetary transmission and bank profitability in the euro area. International Monetary Fund. Available at: https://www.imf.org/external/pubs/ft/wp/2016/wp16172.pdf

Mason, J. W., and Jayadev, A., 2018. A Comparison of Monetary and Fiscal Policy Interaction Under ‘Sound’ and ‘Functional’ Finance Regimes. Metroeconomica 69 (2): 488–508

Kelton, S., 2020. The Deficit Myth. Modern Monetary Theory and How to Build a Better Economy. London: John Murray.

Keynes, J. M., 1937/1983. Collected Writings of John Maynard Keynes, volume 21. London: Palgrave Macmillan.

Koechi, J., 2011. Hyperinflation in Zimbabwe. Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute 2011 Annual Report. Federal Reserve Bank of Dallas

Krugman, P., 2005. Is fiscal policy poised for a comeback?. Oxford Review of Economic Policy, 21(4), 515-523.

Krugman, P., 2013. The Excel Depression. The New York Times. [Online]. Available at: https://www.nytimes.com/2013/04/19/opinion/krugman-the-excel-depression.html?_r=0. [Accessed 19 January 2022].

Lerner, A., 1943. Functional Finance and the Federal Debt. Social Research 10: 38-51.

Martin, S., Longo, F., Lomas, J. and Claxton, K., 2021. Causal impact of social care, public health and healthcare expenditure on mortality in England: cross-sectional evidence for 2013/2014. BMJ open, 11(10), p.e046417.

Martijn, M. J. K., & Samiei, H., 1999. Central bank independence and the conduct of monetary policy in the United Kingdom. International Monetary Fund.

McLeay, M., Radia, A., and Thomas, R., 2014. Money creation in the modern economy. Bank of England Quarterly Bulletin, Q1. Bank of England

Murphy, R., and Hines, C., 2021. The QuEST for a Green New Deal. Available at: https://www.taxresearch.org.uk/Blog/wp-content/uploads/2021/10/The-QuEST-for-a-Green-New-Deal.pdf.

NAO, 2014. The Treasury’s 2010-11 Accounts: the financial stability interventions. National Audit Office. Available at: https://www.nao.org.uk/report/the-treasurys-2010-11-accounts-the-financial-stability-interventions/.

Nevile, J. W., & Kriesler, P. 2014. A bright future can be ours! Macroeconomic policy for non-eurozone Western countries. Cambridge Journal of Economics, 38(6), 1453-1470.

New York Times, 2020. How the Government Pulls Coronavirus Relief Money Out of Thin Air. [online]. Available at: https://www.nytimes.com/2020/04/15/business/coronavirus-stimulus-money.html. [Accessed 19 January 2022].

Nordhaus, W., 1975. The Political Business Cycle. Review of Economic Studies, 42, 169–90

OBR, 2021a. Fiscal Risks Report. Office for Budgetary Responsibility. Available at: https://obr.uk/frr/fiscal-risks-report-july-2021/.

OBR, 2021b. Economic and fiscal outlook—October 2021. Office for Budgetary Responsibility. Available at: https://obr.uk/efo/economic-and-fiscal-outlook-october-2021/

ONS, 2021. Consumer Price Inflation UK, August 2021. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/august2021.

ONS, 2021. UK Government Debt and Deficit March 2021. Office for National Statistics. Available at: https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/

publicspending/bulletins/ukgovernmentdebtanddeficitforeurostatmaast/march2021

Osborne, G., 2011. Speech at the Lord Mayor’s dinner for bankers and merchants of the City of London. Speech on June 2011. Available at: https://www.gov.uk/government/speeches/speech-by-the-chancellor-of-the-exchequer-rt-hon-george-osborne-mp-at-the-lord-mayors-dinner-for-bankers-and-merchants-of-the-city-of-london

Pescatori, A., Leigh, D. and Guajardo, J., 2011. Expansionary Austerity New International Evidence. International Monetary Fund

Pescatori, A., Sandri, D. and Simon, J., 2014. No magic threshold. Finance and Development, 51(002). Available at: https://www.imf.org/external/pubs/ft/fandd/2014/06/pescatori.htm.

Pettifor, A., 2019. The Case for the Green New Deal. London: Verso.

Reinhart, C., and Rogoff, K., 2010. Growth in a Time of Debt. American Economic Review 100(2): 573-78. Available at: https://doi.org/10.1257%2Faer.100.2.573.

Resolution Foundation, 2021. Labour Market Outlook Q4 2021: Wages and the cost of living in 2022. Available at: https://www.resolutionfoundation.org/publications/labour-market-outlook-q4-2021/

Schmelzing, P., 2019. Eight centuries of global real interest rates, RG, and the ‘supra secular’decline, 1311–2018. Bank of England Working Paper No. 845. Available at: https://www.bankofengland.co.uk/working-paper/2020/eight-centuries-of-global-real-interest-rates-r-g-and-the-suprasecular-decline-1311-2018.

Stuckler, D., and Basu, S., 2014. The Body Economic—eight experiments in economic recovery. London: Penguin.

Taylor, J. B., 2000. Reassessing discretionary fiscal policy. Journal of economic Perspectives, 14(3), 21-36.

The Economist, 2018. Central banks should consider offering accounts to everyone. [online] Available at: https://www.economist.com/finance-and-economics/2018/05/26/central-banks-should-consider-offering-accounts-to-everyone. [Accessed 19 January 2022].

The Times, 2021. Levelling up Britain ‘will cost as much as reuniting Germany’. Available at: https://www.thetimes.co.uk/article/levelling-up-britain-will-cost-as-much-as-reuniting-germany-mpjbm23kf.

Thorbecke, W., 1999. Further evidence on the distributional effects of disinflationary monetary policy. Levy Institute Working Paper (No.264). The Levy Institute.

Tréguer, P., 2019. No magic money (tree): justification for austerity. Available at: https://wordhistories.net/2019/12/24/magic-money-tree/.

van Els, P. V., Locarno, A., Morgan, J., and Villetelle, J., 2001. Monetary policy transmission in the euro area: What do aggregate and national structural models tell us?. European Central Bank Working Paper (No. 94). European Central Bank

Van Lerven, F., 2016. Public Money Creation: Outlining alternatives to quantitative easing. Positive Money working paper. Available at: https://positivemoney.org/wp-content/uploads/2016/04/Public-Money-Creation-2.pdf

Van Lerven, F., and Jackson, A., 2018. A government is not a household. Available at: https://cusp.ac.uk/themes/aetw/blog_austerity/

Van Lerven, F., Stirling, A., and Prieg, L., 2021. Calling Time: Replacing the fiscal rules with fiscal referees. New Economics Foundation. Available at: https://neweconomics.org/2021/10/calling-time

Wray, R., 2013. Why Reinhart and Rogoff results are crap. Economonitor. Available at: http://pinguet.free.fr/wraycrap13.pdf

Notes

[1] OBR (2021a, p.3).

[2] OBR (2021b, p.19).

[3] OBR (2021a, p.32), Resolution Foundation (2021).

[4] In this document we will use the terms ‘debt ratio’, ‘public debt ratio’ and ‘public debt-to-GDP ratio’ interchangeably.

[5] OBR (2021a, p.12).

[6] The Times (2021).

[7] OBR (2021a, p.14).

[8] Source: ONS Consumer price inflation time series (code: MM23).

[9] Financial Times (2021).

[10] ‘Fiscal space’ is defined by the IMF (2018) as ‘the room to raise spending or lower taxes relative to a pre-existing baseline, without endangering market access and debt sustainability’.

[11] Reinhart and Rogoff (2010).

[12] Alesina (2010).

[13] Reinhart and Rogoff’s paper was cited explicitly by Paul Ryan in the Republican’s ‘Path to Prosperity’ budget in the US (House Budget Committee, 2012) and by former Coalition Chancellor George Osborne in the UK (Osborne, 2011).

[14] Herndon et al. (2013).

[15] IMF (2013).

[16] Wray (2013).

[17] Breuer (2019), for example, found that the Bocconi papers committed the fallacy of reverse causation, by incorrectly interpreting a reduction in government spending as leading to an increase in GDP, when in fact it was an increase in GDP that was leading to a reduction in spending. When controlling for this issue, Breuer found that a reduction in spending either had no impact or a negative impact on output growth.

[18] Blanchard and Leigh (2013).

[19] Fiscal multipliers show the effect of a change in government spending on output

[20] Guajardo et al. (2010, 2011), Cherif and Hasanov (2018), Fragetta and Tamborini (2019).

[21] Pescatori et al. (2014).

[22] Barro (1974, 1976).

[23] Ricardian Equivalence (RE) is built into DSGE models via the assumption of infinitely lived households which make consumption decisions based on an intertemporal budget constraint and rational expectations. Under these assumptions, any increase in government spending leads to a reduction in private consumption due to the reduction in the present value of after-tax incomes. However, in some cases RE effects may be partially or fully offset by the presence of frictions or alternative assumptions—e.g., households that that consume all their income, as in Galí et al. (2007).

[24] As a result, increases in government borrowing will not automatically lead to an increase the short-term rate (unless the central bank chooses to increase it). Of course, long-term interest rates could conceivably still increase even as short-term rates are held constant. However, arbitrage and maturity transformation behaviour by banks and other agents in the financial markets, combined with an endogenous money supply, means that this result is not a forgone conclusion.

[25] McLeay et al. (2014).

[26] Heimberger (2021).

[27] Forni and Badia (2014).

[28] Krugman (2013).

[29] Stuckler and Basu (2014).

[30] Martin et al. (2021).

[31] Future Hindsight (2020).

[32] Pettifor (2019), Murphy and Hines (2021).

[33] Quote from Jayadev and Mason (2018). MMT argues that this is the correct approach as long as the government/country has control over its own currency, a floating exchange rate, and debts that are denominated in its own currency. See Kelton (2020).

[34] Lerner (1943).

[35] For example, Guajardo et al. (2010, 2011) show that austerity leads to a reduction in GDP, Cherif and Hasanov (2018) find that austerity leads to a reduction in growth which may end up increasing the debt-to-GDP ratio (so that austerity can be self-defeating), while Fragetta and Tamborini (2019) show that austerity policies played a significant role in creating depression type conditions in the eurozone in the 2010s.

[36] Orthodox economics argues that fiscal policy suffers from several drawbacks that make it less suitable than monetary policy for demand management purposes. As a result, it recommends that demand management be allocated to monetary policy and debt sustainability to fiscal policy. The argued drawbacks of fiscal policy are that it suffers from time inconsistency issues, long and variable lags, and generates economic distortions:

Time inconsistency: A time inconsistent policy is a policy that can be changed due to changes in economic conditions, potentially leading to worse long term outcomes compared to if the policy had not been changed. For example, a government might state that buildings on flood plains will not receive compensation in the case of flooding (to discourage building on floodplains), but then change policy and provide compensation (perhaps due to political pressures) when these buildings are flooded. The result of this ‘time inconsistent’ policy is that people are likely to believe the government will compensate property owners in the case of flooding, and so will be more likely to build on floodplains. Similarly, it is argued that fiscal policy is liable to be used by politicians to engineer an economic boom close to an election, leading to a political business cycle (Nordhaus, 1975). Conversely, it is argued that monetary policy can be made to be more time consistent if central bankers follow monetary policy rules and are not subject to political pressures. This is one reason it is argued that central banks should be operationally independent of government.

Long and variable lags: It is argued that fiscal policy is likely to suffer from long and variable lags in terms of the amount of time it takes from deciding the fiscal policy stance needs to be changed (including deliberations about which taxes/spending programme to change and get passed) to the point at which the economy is affected (Taylor, 2000). This, combined with the argument that recessions are oftentimes relatively short, means that a discretionary fiscal policy enacted during a recession may end up impacting the economy during a boom (Blanchard and Perotti, 1999; Krugman, 2005). Conversely, monetary policy is thought to affect the economy in a quicker and more predictable fashion, making it more amendable to shorter term demand management. It is also argued that it can also be reversed more easily than discretionary fiscal policy. Speed of action and automatic reversibility is also the reason why fiscal policy via the operation of automatic stabilisers is tolerated by orthodox economics (Taylor, 2000; Krugman, 2005).

Distortionary: Orthodox economics argues that monetary policy is less distortionary than fiscal policy because fiscal policy directly affects the demand and supply of goods and services within an economy as well as the size of the government sector’s contribution to GDP relative to the private sector. As a result, it is argued that fiscal policy leads to economic outcomes that differ from the ‘optimal’ outcome which would have occurred in the absence of fiscal policy. Conversely, it is argued that monetary policy has an equivalent effect across all agents in an economy and does not affect the size of the government’s contribution to GDP, and as such is not distortionary.

It is important to note that these drawbacks are contested within the economics profession and can also be applied to monetary policy as well. For example, monetary policy can also suffer from long lags and uncertain outcomes, in part because the transmission channels of monetary policy have become less reliable in today’s less regulated and more financialised world (Nevile and Kriesler, 2014). Monetary policy may also be distortionary as it can have different impacts on different agents within the economy—e.g., creditors versus debtors, firms/sectors with high debts versus those with low debts, importers versus exporters (Thorbecke, 1999; van Els et al., 2001). In addition, some of the drawbacks associated with fiscal policy, such as the long and variable lags, may also be addressed by means of increasing the automaticity and improving the design of fiscal policy. Employer of last resort programs, for example, automatically adjust in response to changes in employment in the private sector. Similarly, spending programs can be prepared in advance, so that they are ready to be started/stopped or scaled up/down in response to movements in the business cycle.

[37] Forni and Badia (2014).

[38] Van Lerven et al. (2021).

[39] For a more detailed explanation, see: Van Lerven and Jackson (2018).

[40] Kelton (2020).

[41] Cited in Armstrong (2018).

[42] Bank of England (2017), OBR (2021a), ONS database.

[43] Tréguer (2019).

[44] New York Times (2020), COVID Money Tracker (2022).

[45] Bank of England (2020a).

[46] Net cash requirement (exc PS Banks) (PSNCR exc): £m CPNSA and BoE asset; Purchases total allocation (nominal £mn), both cumulative, March 2020-July 2021.

[47] Bank of England (2020b). In the end neither ability was utilised and government spending has been financed so far by expanded Bank operations on the secondary market.

[48] New York Times (2020).

[49] Consumer price inflation time series. Available at: https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceindices.

[50] Resolution Foundation (2021).

[51] Koechi (2011).

[52] OBR (2021a, p.203).

[53] House of Lords (2021).

[54] APPG (2018).

[55] House of Lords (2021, Chapter 2).

[56] The Economist (2018).

[57] OBR (2021a, p.173-174).

[58] OBR (2021a, p.174).

[59] Unless the government sells off assets it owns (the ‘stock-flow adjustments’).

[60] Galbraith (2011).

[61] For a more detailed explanation see: Buiter (2020, Chapter 2).

[62] Schmelzing (2019).

[63] In a sound finance regime, an increase in inflation (perhaps because demand is too high) will lead the central bank to increase interest rates. If the public debt ratio is at or above its target, this in turn will cause the fiscal authority to reduce its spending in order to prevent its debt ratio from increasing any further (due to higher interest payments). Crucially, the larger the debt ratio, the larger is the impact of a given increase in interest rates on total interest payments, and so the more the government will have to reduce its discretionary spending to compensate for the higher interest payments. This is then likely to create further feedback impacts on output and so the stance of monetary policy will likely need to be adjusted, leading to further adjustments on the fiscal side. These feedback effects between fiscal and monetary policy—feedbacks that increase with the size public debt to GDP ratio—mean that a sound finance regime is unable to hit both an output/price stability target and a debt ratio target once the debt ratio is above a certain threshold. Functional finance regimes, however, are still able to hit both targets even at high public debt ratios. As Jayadev and Mason (2018) themselves put it:

‘When the debt-GDP ratio is sufficiently high, stability requires that the interest rate instrument target the stability of the debt ratio, and the fiscal balance target the output gap. Thus, under a very general set of assumptions, the common metaphor of ‘fiscal space’ gets the relationships between debt levels and policy backward. Stability of the debt ratio requires that the fiscal authorities make less effort, rather than greater effort, to stabilize the public debt as the debt to GDP ratio rises. Countercyclical fiscal policy not only remains possible at high debt levels, but becomes obligatory’.

[64] Martijn and Samiei (1999).

[65] OBR (2021a, p.178-180).

[66] OBR (2021a).

[67] Bezemer et al. (2021).

[68] It is important to note, however, that this approach is akin to financial repression and could lead to further increases in asset prices. See e.g., Jobst and Lin (2016).

- The full working paper is available for download in pdf (1.7MB). | Jackson, A., Jackson, T. and F. van Lerven, 2022. Beyond the Debt Controversy—Re-framing fiscal and monetary policy for a post-pandemic era. CUSP Working Paper No. 31. Guildford: Centre for the Understanding of Sustainable Prosperity.

- A policy briefing was also produced from this work for the UK All-Party Parliamentary Group on Limits to Growth.

Acknowledgements