Economic policy and the voluntary sector: How to combat the issue of rising needs and declining resources

When the economy dips, needs rise and the resources open to charities dip too. What we need is a system that is effective at stopping this ‘scissors effect’ and at meeting needs, not just where, but when they arise, Chief Executive of Pilotlight and former CUSP advisor, Ed Mayo, argues in this guest blog. This blog first appeared on the New Philanthropy Capital website.

Charities can stand tall. This is something that I learned in 1992 from the economist Paul Ekins when I started working in the charity sector. If your model of wealth creation encompasses social and environmental outcomes, then charities are not an afterthought, a recipient of discretionary largesse: charities are wealth creators.

The idea of wealth as sustainable prosperity has developed and flourished in the intervening years, leading to a flourishing range of reforms of national accounts, resource and energy input-output analyses, well-being indicators and interventions, and sophisticated economy-environment modelling. But to date, no spotlight has really turned to the third sector as a driver for social and environmental outcomes. As a result, we are in economic terms, still an afterthought.

Charities at full stretch and stress

Since the first lockdown began, voluntary sector networks have come together to try to speak with one voice to government. The sector is a kaleidoscope of different forms of action and activity and finding ways through this towards a coherent common platform, after years of falling short, is a tribute to the current generation of voluntary sector leaders. Under the campaign tag of #NeverMoreNeeded, the case was made for government funding to sustain the services that charities provide—a campaign that won funding commitments of around £750m, welcome support but a fraction of what would in fact be needed. As Nicole Sykes points out, this is a fraction of what the private sector has seen in terms of support—Tesco received a tax cut of close to this on business rates relief alone (£585m).

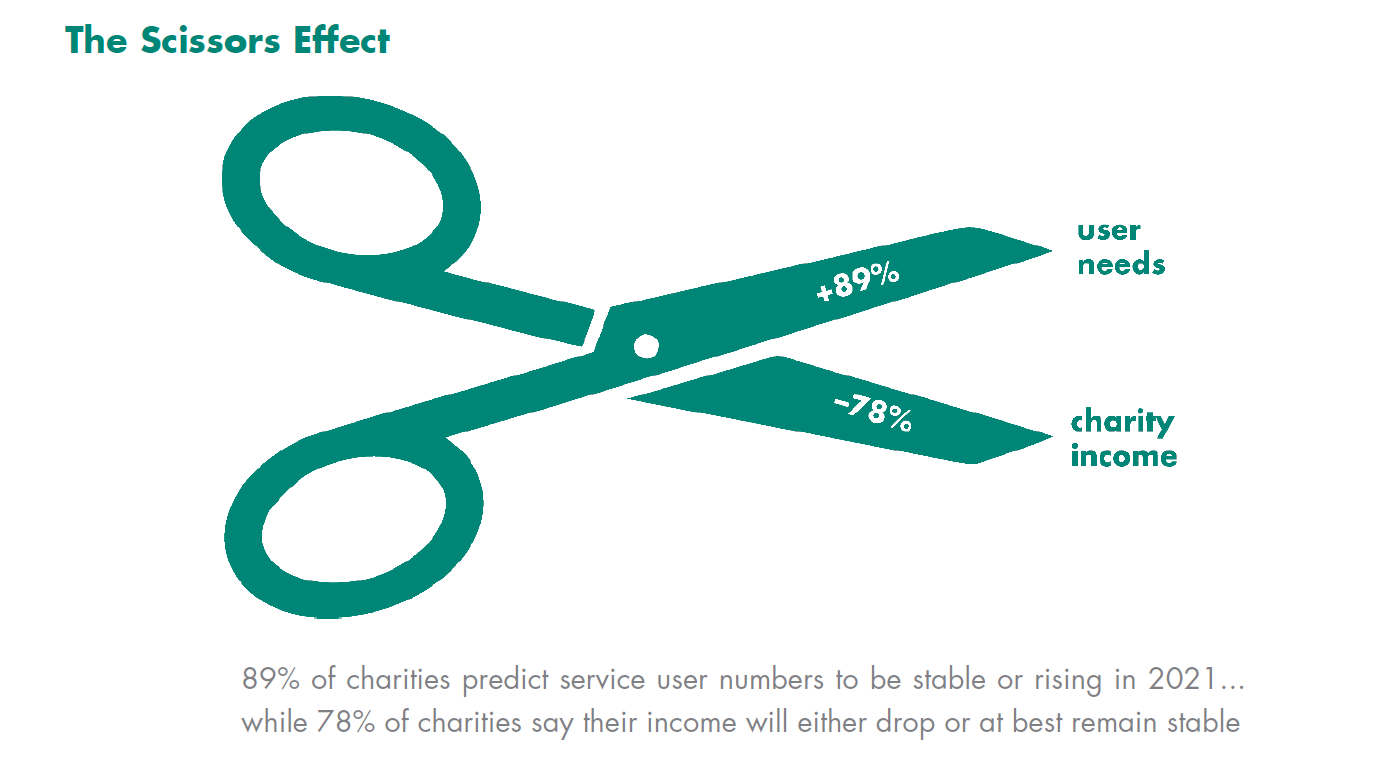

Here at Pilotlight, the capacity building charity, we have worked with over 100 charities over the course of the pandemic. For all of the extraordinary success of community volunteering, charted in the report to government by Danny Kruger MP, what emerges for me is a story of voluntary organisations at full stretch and stress, weakened by the difficult funding and resource environment in which they work. Our new research with over 250 small charity leaders, to mark the opening up to applications of the new Weston Charity Awards, points to what we can call a ‘scissors effect’, in which charities face both rising needs and falling income. 78% of small charity leaders told us that they expect their income to either drop or at best remain stable over the course of the year, while 67% also expect to help more people.

Of course, the pandemic conditions are atypical. Every sector has been calling for public support and every sector has received it, primarily through employment subsidies, for example the furlough scheme. But the treatment of the voluntary sector as an afterthought, at a time when the economy was turning down and the need for charitable services was greater than ever, made me ask how policy would be designed if we did have an integrated society-economy model driving the formation of public policy.

Counter-cyclical support for charities

One building block for such a model, if it were possible, would be the concept of ‘unmet needs’. The concept of needs has been developed in an economic context at the micro-level by the Chilean economist, and recipient of the Right Livelihood Award, Manfred Max-Neef. The UK’s Ian Gough has proposed a framework for assessing needs at the macro-level and has connected this with the ‘doughnut economics’ of Kate Raworth, arguing that the primary measure of economic productivity should be the meeting of needs within the constraints of ecological boundaries.

The concept of ‘unmet needs’, articulated for example by the Young Foundation, steps back from some of the complexities of tracking needs, towards a simpler calculus of tracking needs that are not satisfied (in Max-Neef’s terms). This means, rather than track every bird to tell if it is Spring, you look for one—perhaps a chiffchaff.

What such a model might suggest, above all, is that we need support for charity and community action that is counter-cyclical, because at the moment, it is all pro-cyclical in socio-economic terms—in the sense that in an economic downturn, social needs go up while the resources to meet them go down. This means that ‘unmet needs’ soar.

On mental health, for example, a review of over 100 research projects worldwide in the BMC Journal of Public Health concludes that, ‘epidemiological data comparing changes in health status before and after a recession are consistent and report negative associations with mental health and increased mental health problems.’ From depression and substance abuse through to suicide, ‘unmet needs’ are affected by the state of the wider economy.

In terms of charities responding to these ‘unmet needs’, funding and fundraising lags behind slightly but broadly tracks the economic cycle, in terms of household and business contributions to charity. Recent research by Pro Bono Economics looks at the performance of different income streams for charities since 2008, concluding that while there are differences, charity income and economic output (GDP) move broadly in line with each other. As with unemployment, there may be a lag, but the correlation stands up. So, when the economy turns down, the resources open to charities turn with it. As a result, we have the least efficient system over time that we could imagine, if starting from a needs perspective.

What we want is a system that is effective at meeting needs, not just where, but also when they arise.

Stopping the ‘scissors effect’

How can we address this ‘scissors effect’ of rising needs and a decline in resources when the economic cycle turns down? I would suggest that the most effective measure would be a variable rate of Gift Aid. This would mean that the level of tax relief that charities can claim on Gift Aid would be open to adjustment, rather than stay fixed at current levels. This would be a policy intervention akin to the stabilisers of unemployment benefits, which rise when the economy loses more jobs than it creates. Such ‘charity stabilisers’ would put money in across the sector. It would also avoid the admin, delays and incentive complexities of the emergency grant programmes that we are caught up in at present and that will now be the subject of an investigation by the National Audit Office.

Of course, Gift Aid is a tax credit, so it is tax revenue foregone and a form of public sector spending, but it is an efficient one and in the main it has positive incentives for charities. The centuries-old principle that charities should not pay income tax (started in the UK, and spread worldwide) is mirrored in the principle that tax on income gifted to charities can be tax free, and this feels simple and logical to me.

At present, charities reclaim the tax to the level that the donor would have paid, assuming a basic rate of income tax (20%), but that is arguably a shorthand rather than a ceiling. The Chartered Institute of Fundraising and partners have argued for a ‘Gift Aid Emergency Relief Package’, which suggests that every percentage point the effective reclaim rate for charities was increased would raise £90m per annum for UK charities, all things being equal. Where charity donations are falling, at a rate of perhaps around 20% in 2020, there is then less to claim relief on, so the total would be less—around £72m per annum (although conversely, a rise in Gift Aid reliefs might also incentivise and increase more private giving). What this means is that a Gift Aid rate of 25% would put £450m into the sector, going on the former assumption, all things being equal, or more realistically, around £360m at a point in the economic cycle that would normally see a drop in donations.

To get to the scale that is required to equip charities to meet the rise in ‘unmet needs’, a 40% rate would be a more effective option, doubling the current rate of relief, and releasing £1.8bn or around £1.4bn per annum. Of course, there could be a perceived risk in delinking Gift Aid from income tax rates, if this muddies the underlying principle that donations to charity should be free from tax. Other options, more modest in their impact, could include the full 40% or 50% relief for higher rate tax payers going automatically to the charity, unless the donor opts-out—something advocated by the Charity Tax Commission in this report. Or, given that Gift Aid is not even in its distribution across charities, there could be grant programmes as a complement or an alternative, to help rebalance the distribution of funds. Although there are inevitably administrative costs with grant programmes, both for the disbursing of funds and for the charities that are apply for them, successfully or not. On balance, boosting Gift Aid would be a simpler option.

There could also be a commensurate case for reducing Gift Aid levels in an economic upswing—the logic is there, but arguably the principle of not seeking to tax activity that is for the public benefit would suggest to me that the basic rate of taxation should always be the floor for Gift Aid, with variation only taking place above this level.

These are all relatively simple calculations, but the fundamental point is sound, which is that the voluntary sector responds to needs, but in treating the sector in policy terms as if it were a market (where all demand, in economic terms, is assumed to be ‘effective demand’, i.e. it comes with money attached), we end up with rapidly rising unmet needs at exactly the wrong time.

For now, the Winter Economy Plan from the Treasury makes not a single reference to charities and social enterprises. The Spending Review refers to business over 150 times and to charities twice. Without the tools to understand the true role of charities in the economy, meeting needs that are beyond the reach of markets and the state, creating wealth in a wider sense, we will continue to be this…

…an afterthought.