Modelling Transition Risk

Tim Jackson summarises the recent TRansit project which has pioneered a novel agent-based, stock-flow consistent macro-economic model. Tim discusses the findings from the project and sets them in the context of the Bank of England’s work on ‘transition risk’. This blog first appeared on the Rebuilding Macroeconomics website.

The world is now hotter than at any time in the last 12,000 years. The year 2020 tied with 2016 for the dubious honour of being the hottest year on record. A rapid transition to a net zero carbon economy has become an urgent political priority.

The challenge is partly technological. But it is also economic and financial. As Black Rock chair, Larry Fink, wrote in his recent annual letter to CEOs, ‘climate risk is investment risk’. It’s a point which has also been made by the UN Climate Envoy, Mark Carney. In his former role as Governor of the Bank of England, Carney distinguished between ‘physical risks’—the impacts associated with physical damage from climate change—and ‘transition risks’—the impacts that rapidly shifting investment portfolios can have on the economy. Since the Stern review we’ve known quite a lot about physical risk. Much less is known about transition risk. The aim of Modelling Transition Risk was to help redress that shortcoming.

It’s no trivial task. The transition to net zero involves replacing entire technologies, supply chains and infrastructures over timescales shorter than the life of existing assets. It requires directed (or incentivised) investment at a scale usually seen during periods of war or rapid urbanisation, rather than at a scale typical of mature, post-industrial economies. And it implies fundamental changes in the behaviours of financial actors across the economy that go well beyond any historically accepted ‘normal’.

These three features of the transition—rapid structural change, massive investment shifts and ‘post-normal’ behaviours—mean that conventional equilibrium or partial equilibrium models aren’t much help to us. They assume too much homogeneity in behaviour. They have little or nothing to represent the complex structure of financial balance sheets through which transition risks may be propagated. And they are likely to miss the dynamic feedbacks that occur between the real and the financial economy, as a myriad of agents interact with each other in the course of a rapid technological transition. Our work sought to address these failings. What we were looking for was an approach that could handle disequilibrium behaviours and in particular simulate the complex interactions that arise from the balance sheet interactions that affect financial stability.

To achieve this, we brought together a team from the Universities of Surrey and Sussex (in the UK) and L’Aquila (in Italy) with a combined expertise in energy transitions, agent-based (AB) modelling and financial modelling—and in particular in what is known as stock-flow consistent (SFC) modelling. The 18-month project developed a beta version of a closed, demand-driven AB-SFC model (TRansit) which has a high degree of non-linearity, heterogeneity and endogeneity. We believe it is the first AB-SFC model developed specifically to simulate the complex, emergent, disequilibrium behaviour involved in a rapid and more or less complete transition from brown (fossil) to green (renewable) energy.

The theoretical complexity is daunting. The multiplicity of agents that characterises AB approaches and the strict financial accountability inherent in SFC modelling, taken together, impose a set of stringent validation criteria on each iteration in the development of an AB-SFC model. The endogenous generation of a stable ‘reference scenario’ representative of a mature industrial economy imposes a significant ‘entrance barrier’ to a useful model. A fundamental lesson learned from modelling this process was the importance of the stabilising role played by government. As a large, relatively homogeneous economic actor in a universe of much smaller, heterogeneous agents, each of whom is operating under conditions of uncertainty, incomplete information and bounded rationality, government has the potential to operate as a powerful ‘automatic stabiliser’.

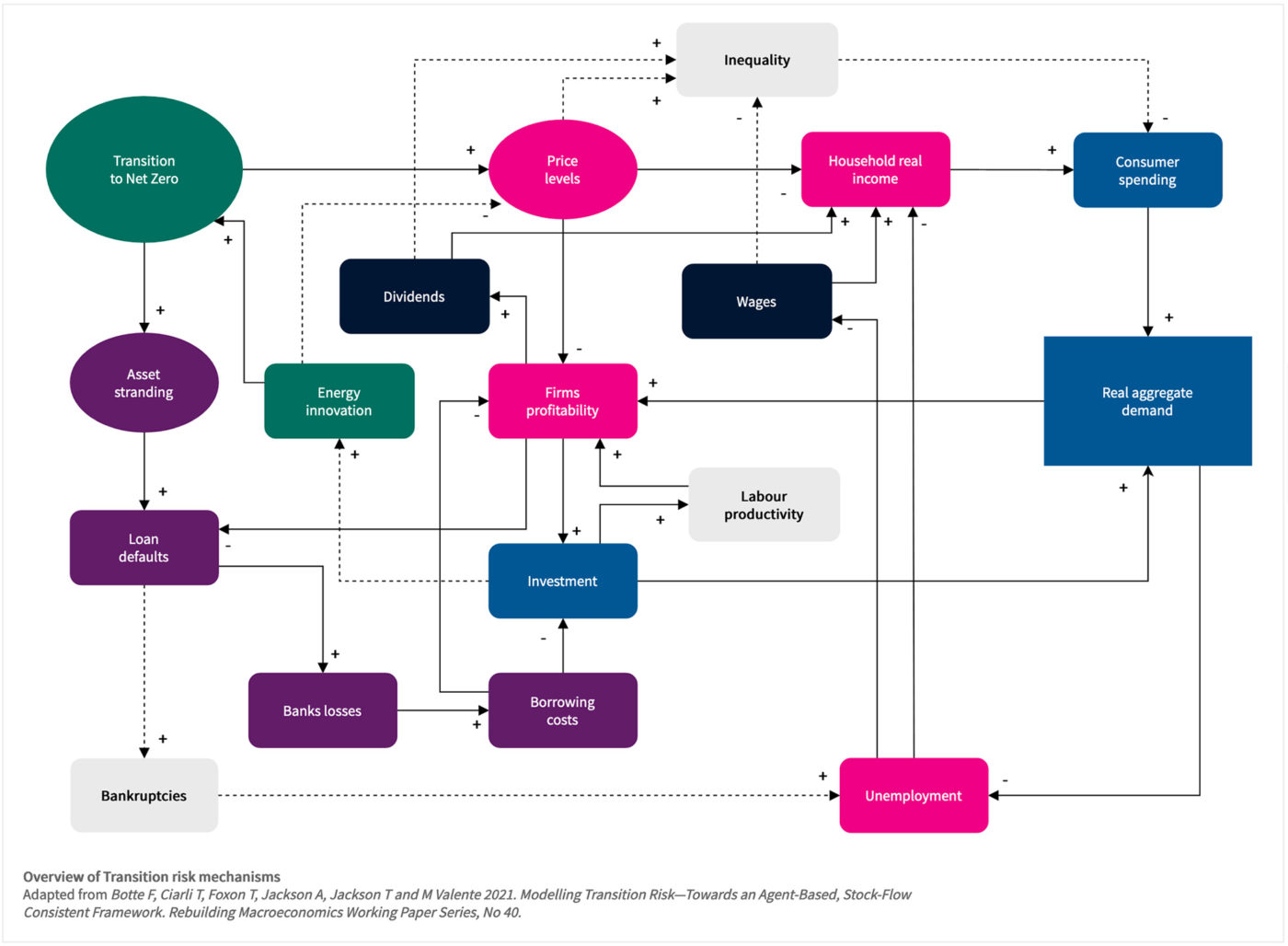

The project also demonstrated the ability of an AB-SFC framework to simulate the complex, emergent behaviour of a mature, industrial economy under conditions such as those likely to be encountered during a rapid transition towards net zero carbon. We were able to illustrate several key mechanisms through which transition risks are transmitted and to show how the complex interactions between these mechanisms may lead to a protracted period of instability.

Our simulations showed, for instance, how energy price rises and increased green investment can represent opposing forces on aggregate demand during the initial phase of a fast transition from brown to green energy. We identified circumstances under which these opposing forces can lead to the stranding of assets, an increase in loan defaults and a period of financial instability that extends beyond the energy sector, giving rise to what Carney has called the ‘pro-cyclical crystallisation of losses‘. We also highlighted the risk that such conditions can lead to higher income inequality.

None of these effects is necessarily fatal to a successful transition. But they highlight the need to recognise the economy as a complex dynamic system and to develop tools (such as TRansit) which can help policymakers to understand both the impacts and how to address them. The Modelling Transition Risk grant is now closed. But our work on TRansit is ongoing. The model itself is available online. Those interested in using it and developing it are welcome to do so. The immediate focus of the TRansit team will be on improving the calibration of the model, generating a wider range of transition scenarios and simulating the effectiveness of policies aimed at mitigating transition risk.

One of Carney’s last acts at the Bank of England was to initiate a climate ‘stress test’ designed to assess the climate-related exposure of financial sector institutions across the UK. Postponed from last year due to the global pandemic, the delayed stress test will be launched in June this year. Early findings will be crucial for the 26th Conference of the Parties (CoP) to the climate change convention in November which must engage seriously with climate-related financial resilience. It’s our hope that the TRansit model will also prove to be a useful tool in that process.